Authors

Summary

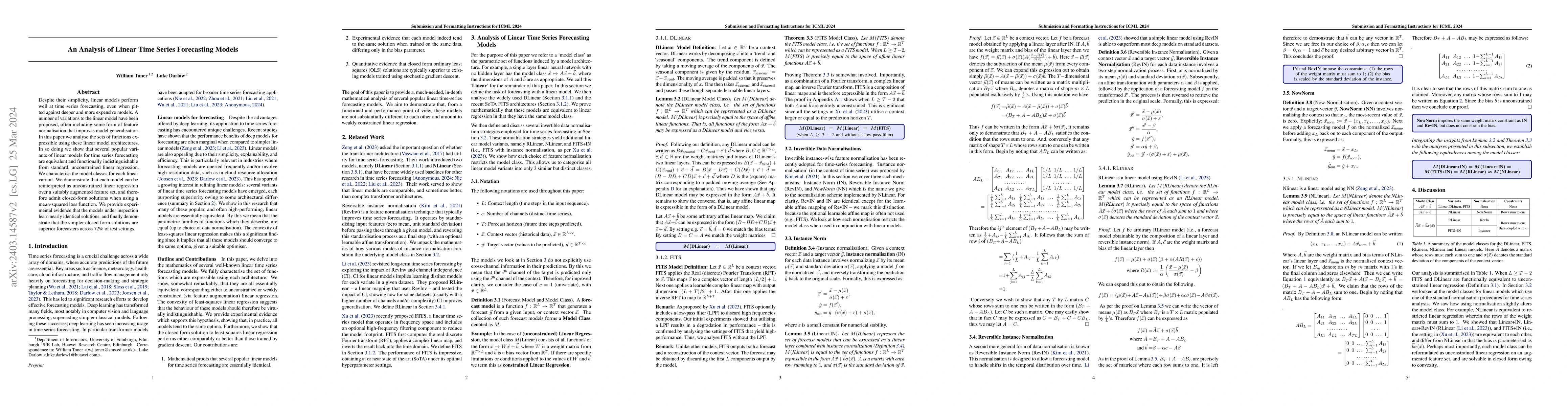

Despite their simplicity, linear models perform well at time series forecasting, even when pitted against deeper and more expensive models. A number of variations to the linear model have been proposed, often including some form of feature normalisation that improves model generalisation. In this paper we analyse the sets of functions expressible using these linear model architectures. In so doing we show that several popular variants of linear models for time series forecasting are equivalent and functionally indistinguishable from standard, unconstrained linear regression. We characterise the model classes for each linear variant. We demonstrate that each model can be reinterpreted as unconstrained linear regression over a suitably augmented feature set, and therefore admit closed-form solutions when using a mean-squared loss function. We provide experimental evidence that the models under inspection learn nearly identical solutions, and finally demonstrate that the simpler closed form solutions are superior forecasters across 72% of test settings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCharacteristic Root Analysis and Regularization for Linear Time Series Forecasting

Zheng Wang, Wanfang Chen, Kaixuan Zhang et al.

Revisiting Long-term Time Series Forecasting: An Investigation on Linear Mapping

Zhe Li, Zenglin Xu, Yiduo Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)