Summary

In this work, we investigate the impact of the COVID-19 pandemic on sovereign bond yields. We consider the temporal changes from financial correlations using network filtering methods. These methods consider a subset of links within the correlation matrix, which gives rise to a network structure. We use sovereign bond yield data from 17 European countries between the 2010 and 2020 period. We find the mean correlation to decrease across all filtering methods during the COVID-19 period. We also observe a distinctive trend between filtering methods under multiple network centrality measures. We then relate the significance of economic and health variables towards filtered networks within the COVID-19 period. Under an exponential random graph model, we are able to identify key relations between economic groups across different filtering methods.

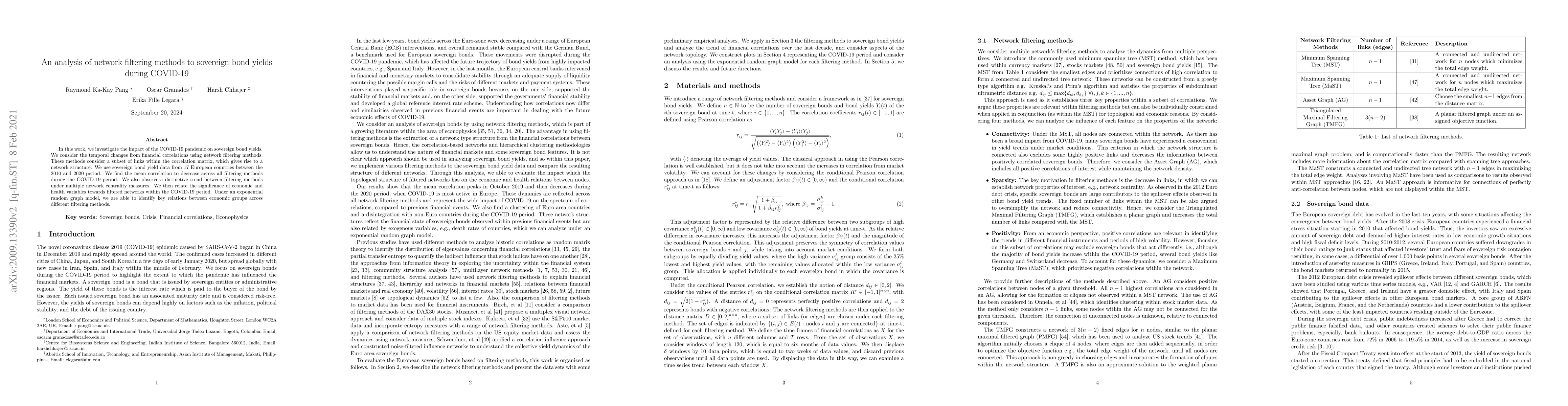

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCovid-19 Analysis Using Tensor Methods

Ramin Goudarzi Karim, Dipak Dulal, Carmeliza Navasca

| Title | Authors | Year | Actions |

|---|

Comments (0)