Summary

This paper analyses the implementation and calibration of the Heston Stochastic Volatility Model. We first explain how characteristic functions can be used to estimate option prices. Then we consider the implementation of the Heston model, showing that relatively simple solutions can lead to fast and accurate vanilla option prices. We also perform several calibration tests, using both local and global optimization. Our analyses show that straightforward setups deliver good calibration results. All calculations are carried out in Matlab and numerical examples are included in the paper to facilitate the understanding of mathematical concepts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

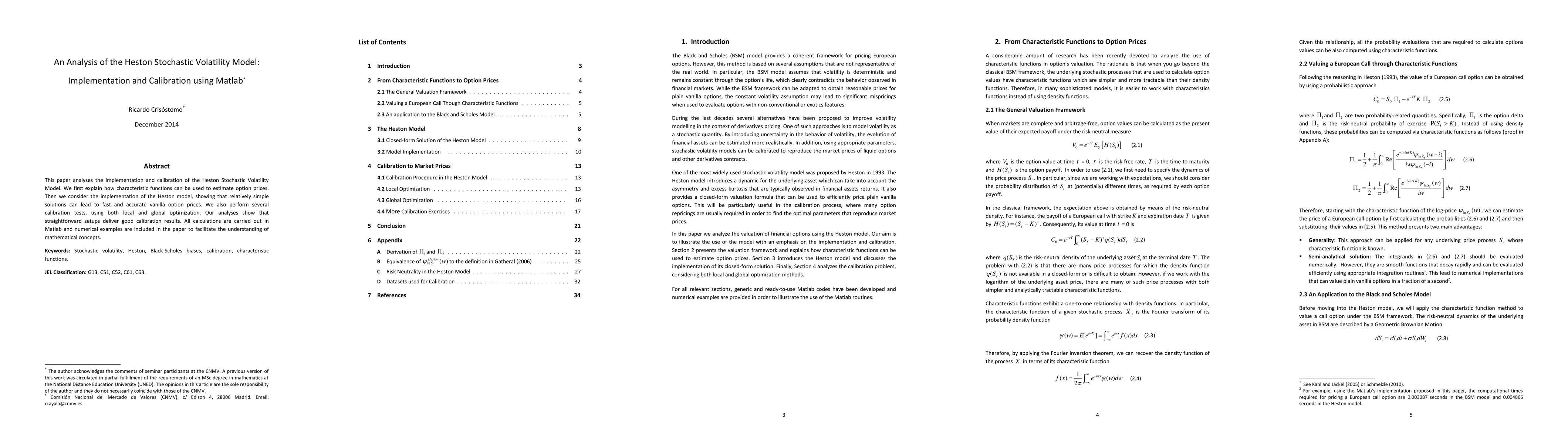

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)