Authors

Summary

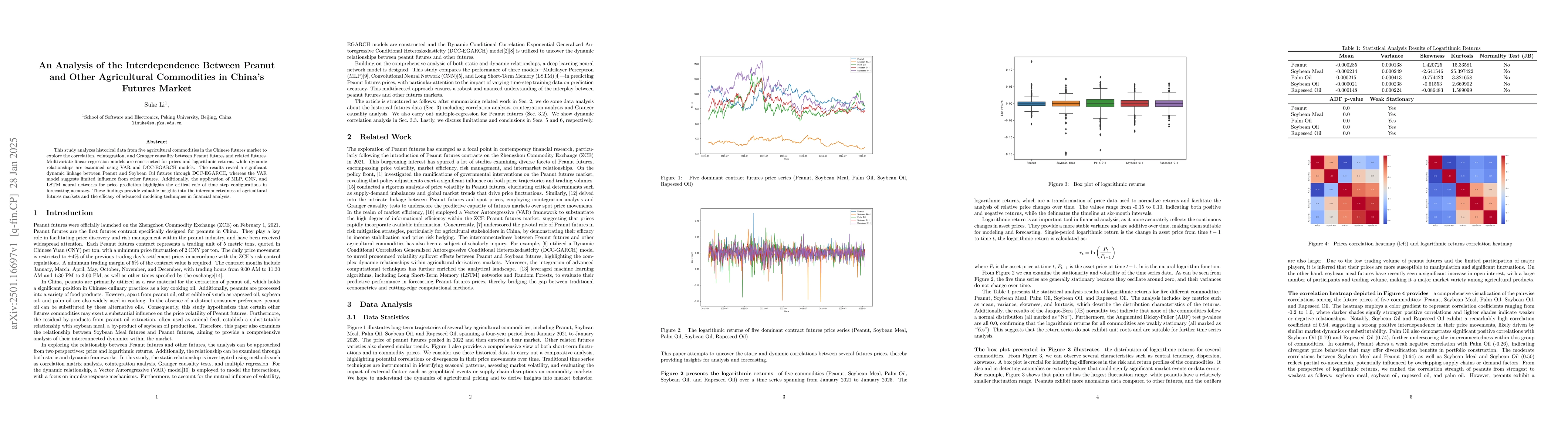

This study analyzes historical data from five agricultural commodities in the Chinese futures market to explore the correlation, cointegration, and Granger causality between Peanut futures and related futures. Multivariate linear regression models are constructed for prices and logarithmic returns, while dynamic relationships are examined using VAR and DCC-EGARCH models. The results reveal a significant dynamic linkage between Peanut and Soybean Oil futures through DCC-EGARCH, whereas the VAR model suggests limited influence from other futures. Additionally, the application of MLP, CNN, and LSTM neural networks for price prediction highlights the critical role of time step configurations in forecasting accuracy. These findings provide valuable insights into the interconnectedness of agricultural futures markets and the efficacy of advanced modeling techniques in financial analysis.

AI Key Findings

Generated Jun 13, 2025

Methodology

This study analyzes historical data from five agricultural commodities in China's futures market, employing multivariate linear regression models, VAR, DCC-EGARCH models, and neural networks (MLP, CNN, LSTM) for price prediction.

Key Results

- Significant dynamic linkage between Peanut and Soybean Oil futures through DCC-EGARCH, while VAR model suggests limited influence from other futures.

- Soybean Meal exhibits strong predictive power over Peanut (p=0.02), indicating its role as a leading indicator.

- Soybean Oil demonstrates significant Granger causality toward Palm Oil (p=0.01), reflecting potential substitution effects or shared supply chain influences.

- Peanut shows no statistically significant causal relationship with other commodities (p>0.10 for all pairs), suggesting its price dynamics may be driven by idiosyncratic factors.

- Soybean Oil is identified as the primary driver of Peanut price movements, with weaker contributions from Rapeseed Oil.

- Neural networks, especially LSTM, show effective predictive performance for Peanut prices, highlighting the importance of time step configurations in forecasting accuracy.

Significance

This research provides valuable insights into the interconnectedness of agricultural futures markets and the efficacy of advanced modeling techniques in financial analysis, which can aid in risk management and investment strategies.

Technical Contribution

The paper presents a comprehensive analysis using VAR, DCC-EGARCH, and neural networks, demonstrating their utility in understanding complex dynamics in agricultural futures markets.

Novelty

This work stands out by combining traditional econometric methods (regression, Granger causality) with advanced machine learning techniques (MLP, CNN, LSTM) to analyze and predict Peanut futures prices in the context of China's agricultural commodities futures market.

Limitations

- The study is constrained by limited data, which impacts the reliability of the results.

- Other factors influencing prices and returns are not considered, suggesting a need for further research.

Future Work

- Investigate the impact of macroeconomic factors, weather data, and global market trends on Peanut futures.

- Explore the application of these models and techniques to other agricultural commodities to generalize findings.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCorrelation structure analysis of the global agricultural futures market

Wei-Xing Zhou, Yun-Shi Dai, Ngoc Quang Anh Huynh et al.

Tail dependence structure and extreme risk spillover effects between the international agricultural futures and spot markets

Wei-Xing Zhou, Yun-Shi Dai, Peng-Fei Dai

No citations found for this paper.

Comments (0)