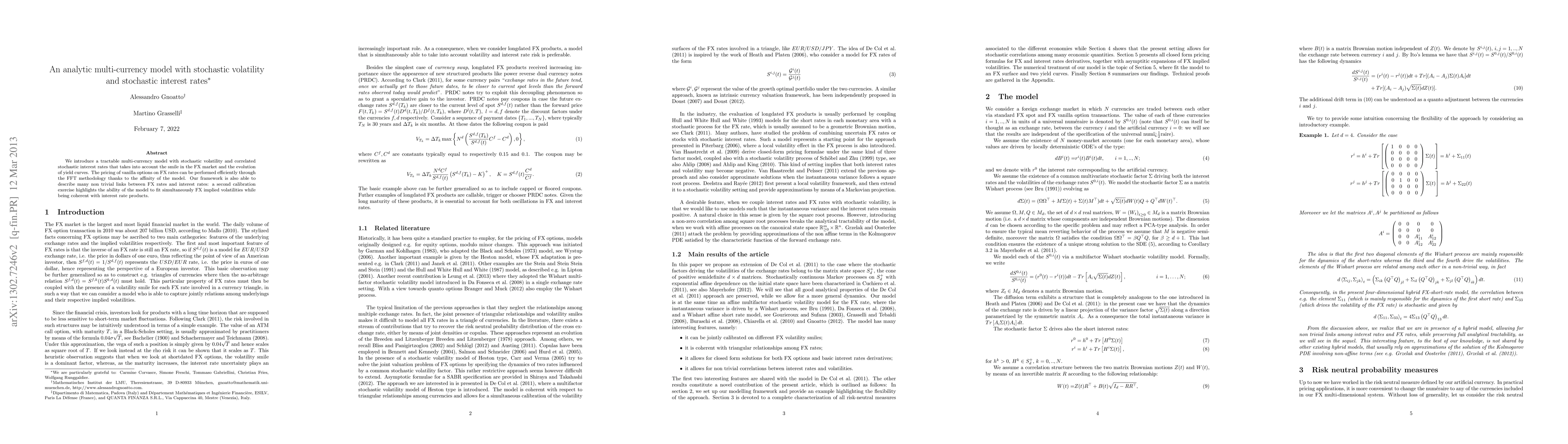

Summary

We introduce a tractable multi-currency model with stochastic volatility and correlated stochastic interest rates that takes into account the smile in the FX market and the evolution of yield curves. The pricing of vanilla options on FX rates can be performed effciently through the FFT methodology thanks to the affinity of the model Our framework is also able to describe many non trivial links between FX rates and interest rates: a second calibration exercise highlights the ability of the model to fit simultaneously FX implied volatilities while being coherent with interest rate products.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtensions of Dupire Formula: Stochastic Interest Rates and Stochastic Local Volatility

Orcan Ogetbil, Bernhard Hientzsch

Option Pricing with Stochastic Volatility, Equity Premium, and Interest Rates

Diep Luong-Le, Nicole Hao, Echo Li

| Title | Authors | Year | Actions |

|---|

Comments (0)