Authors

Summary

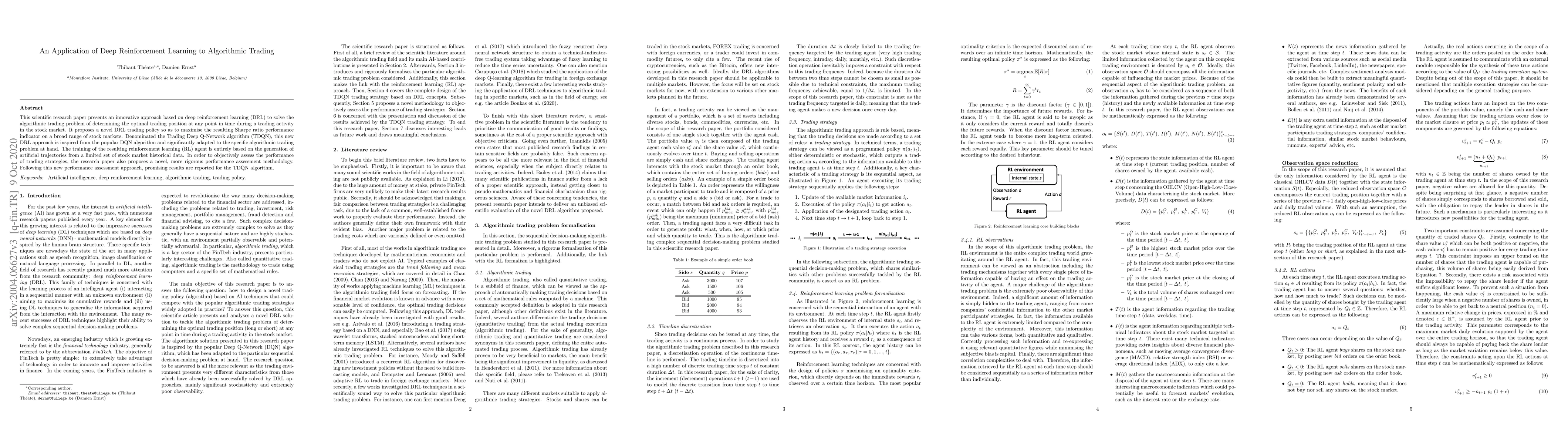

This scientific research paper presents an innovative approach based on deep reinforcement learning (DRL) to solve the algorithmic trading problem of determining the optimal trading position at any point in time during a trading activity in stock markets. It proposes a novel DRL trading strategy so as to maximise the resulting Sharpe ratio performance indicator on a broad range of stock markets. Denominated the Trading Deep Q-Network algorithm (TDQN), this new trading strategy is inspired from the popular DQN algorithm and significantly adapted to the specific algorithmic trading problem at hand. The training of the resulting reinforcement learning (RL) agent is entirely based on the generation of artificial trajectories from a limited set of stock market historical data. In order to objectively assess the performance of trading strategies, the research paper also proposes a novel, more rigorous performance assessment methodology. Following this new performance assessment approach, promising results are reported for the TDQN strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlgorithmic Trading Using Continuous Action Space Deep Reinforcement Learning

Mahdi Shamsi, Farokh Marvasti, Naseh Majidi

| Title | Authors | Year | Actions |

|---|

Comments (0)