Summary

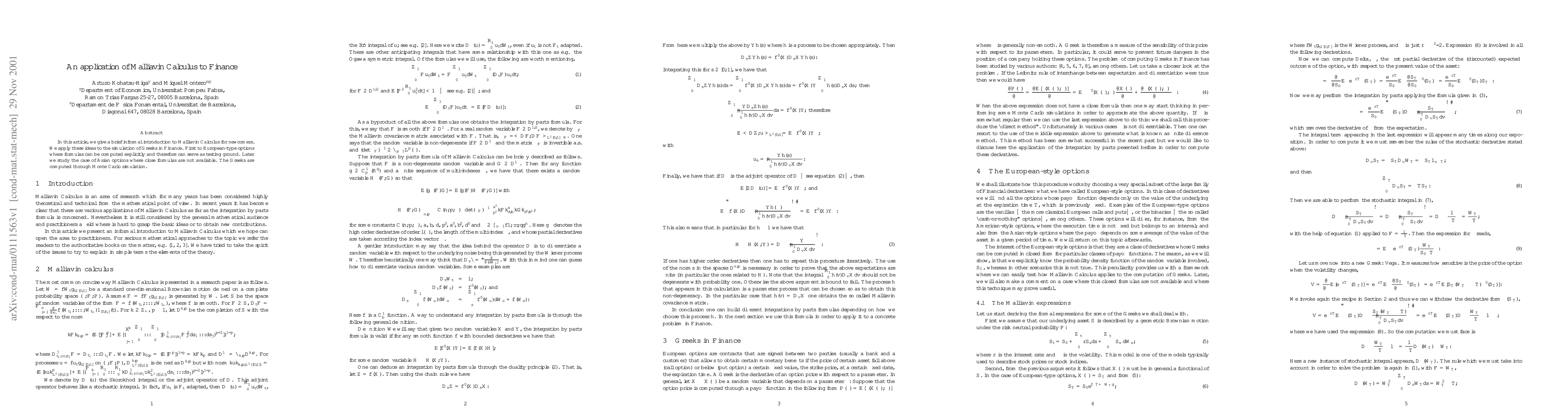

In this article, we give a brief informal introduction to Malliavin Calculus for newcomers. We apply these ideas to the simulation of Greeks in Finance. First to European-type options where formulas can be computed explicitly and therefore can serve as testing ground. Later we study the case of Asian options where close formulas are not available. The Greeks are computed through Monte Carlo simulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)