Summary

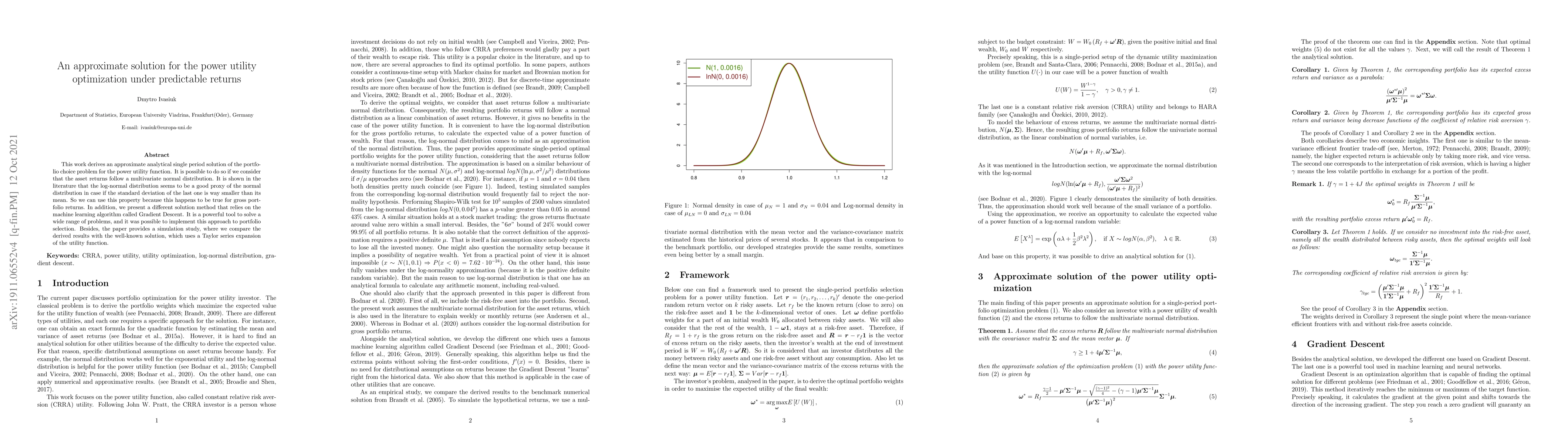

This work derives an approximate analytical single period solution of the portfolio choice problem for the power utility function. It is possible to do so if we consider that the asset returns follow a multivariate normal distribution. It is shown in the literature that the log-normal distribution seems to be a good proxy of the normal distribution in case if the standard deviation of the last one is way smaller than its mean. So we can use this property because this happens to be true for gross portfolio returns. In addition, we present a different solution method that relies on the machine learning algorithm called Gradient Descent. It is a powerful tool to solve a wide range of problems, and it was possible to implement this approach to portfolio selection. Besides, the paper provides a simulation study, where we compare the derived results with the well-known solution, which uses a Taylor series expansion of the utility function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Exact Solution of the Multi-Period Portfolio Choice Problem for an Exponential Utility under Return Predictability

Wolfgang Schmid, Taras Bodnar, Nestor Parolya

Optimal Trading under Instantaneous and Persistent Price Impact, Predictable Returns and Multiscale Stochastic Volatility

Ronnie Sircar, Patrick Chan, Iosif Zimbidis

Portfolio Construction with Gaussian Mixture Returns and Exponential Utility via Convex Optimization

Stephen Boyd, Eric Luxenberg

Deep Reinforcement Trading with Predictable Returns

Alessio Brini, Daniele Tantari

| Title | Authors | Year | Actions |

|---|

Comments (0)