Summary

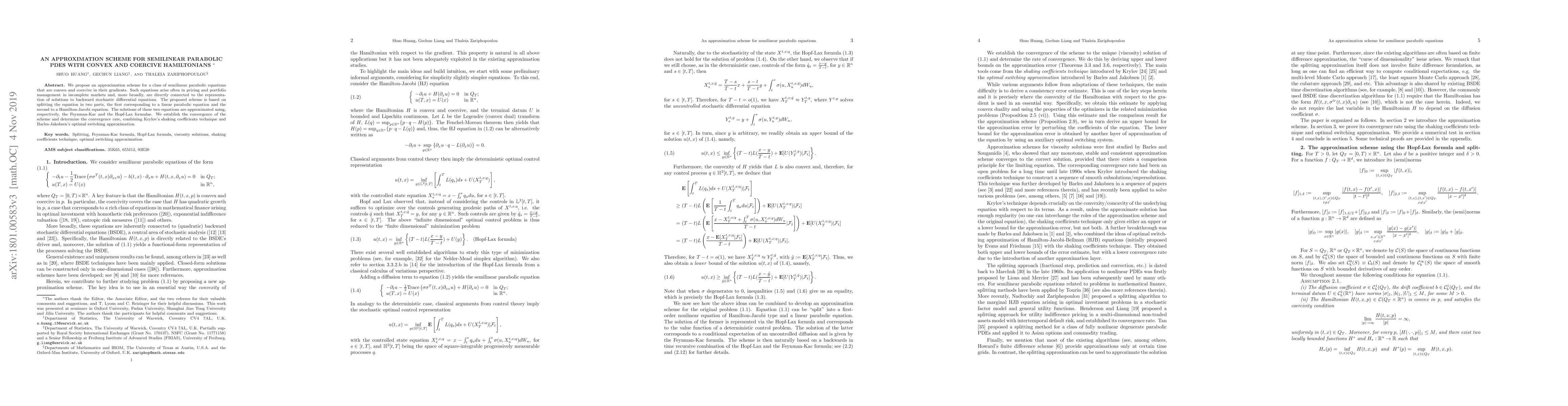

We propose an approximation scheme for a class of semilinear parabolic equations that are convex and coercive in their gradients. Such equations arise often in pricing and portfolio management in incomplete markets and, more broadly, are directly connected to the representation of solutions to backward stochastic differential equations. The proposed scheme is based on splitting the equation in two parts, the first corresponding to a linear parabolic equation and the second to a Hamilton-Jacobi equation. The solutions of these two equations are approximated using, respectively, the Feynman-Kac and the Hopf-Lax formulae. We establish the convergence of the scheme and determine the convergence rate, combining Krylov's shaking coefficients technique and Barles-Jakobsen's optimal switching approximation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)