Summary

Conic martingales refer to Brownian martingales evolving between bounds. Among other potential applications, they have been suggested for the sake of modeling conditional survival probabilities under partial information, as usual in reduced-form models. Yet, conic martingale default models have a special feature; in contrast to the class of Cox models, they fail to satisfy the so-called \emph{immersion property}. Hence, it is not clear whether this setup is arbitrage-free or not. In this paper, we study the relevance of conic martingales-driven default models for practical applications in credit risk modeling. We first introduce an arbitrage-free conic martingale, namely the $\Phi$-martingale, by showing that it fits in the class of Dynamized Gaussian copula model of Cr\'epey et al., thereby providing an explicit construction scheme for the default time. In particular, the $\Phi$-martingale features interesting properties inherent on its construction easing the practical implementation. Eventually, we apply this model to CVA pricing under wrong-way risk and CDS options, and compare our results with the JCIR++ (a.k.a. SSRJD) and TC-JCIR recently introduced as an alternative.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

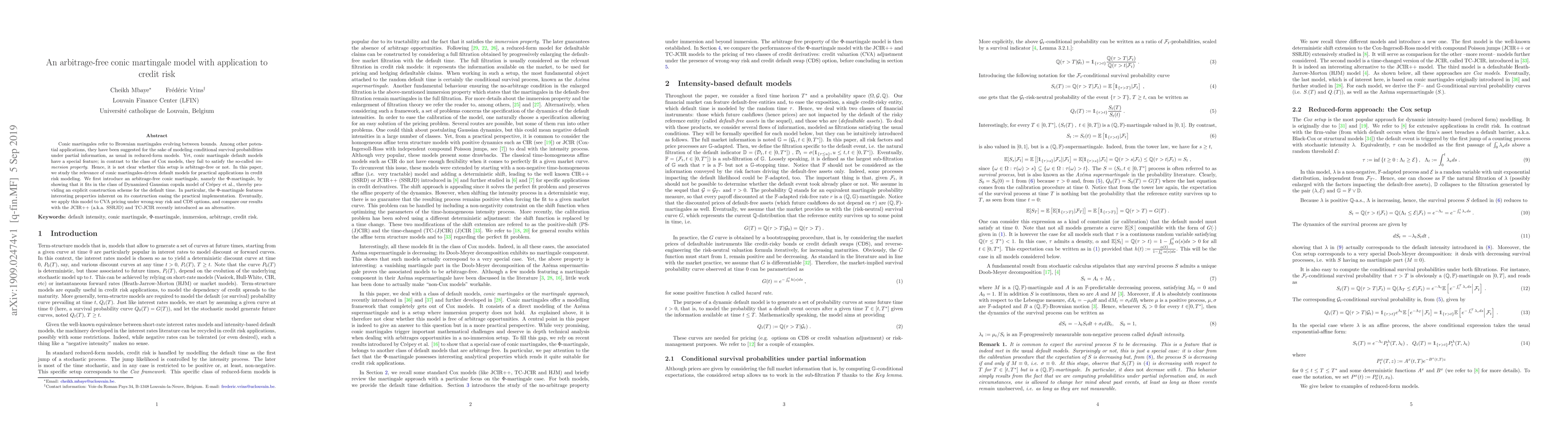

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)