Summary

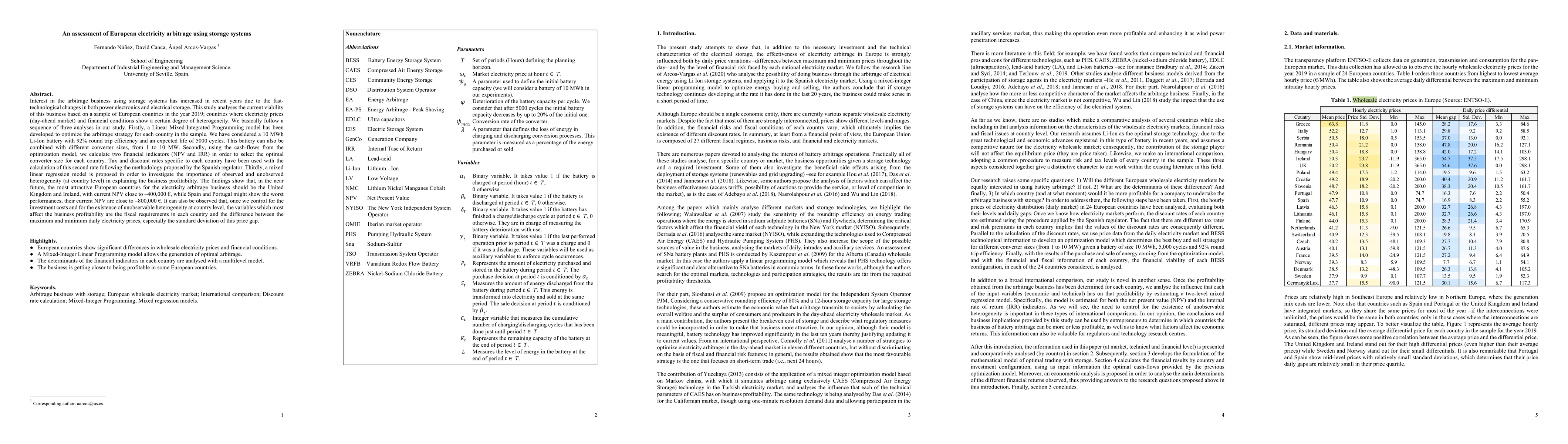

This study analyses the current viability of this business based on a sample of European countries in the year 2019; countries where electricity prices (day-ahead market) and financial conditions show a certain degree of heterogeneity. We basically follow a sequence of three analyses in our study. Firstly, a Linear Mixed-Integrated Programming model has been developed to optimize the arbitrage strategy for each country in the sample. Secondly, using the cash-flows from the optimization model, we calculate two financial indicators (NPV and IRR) in order to select the optimal converter size for each country. Tax and discount rates specific to each country have been used with the calculation of this second rate following the methodology proposed by the Spanish regulator. Thirdly, a mixed linear regression model is proposed in order to investigate the importance of observed and unobserved heterogeneity (at country level) in explaining the business profitability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConformal Uncertainty Quantification of Electricity Price Predictions for Risk-Averse Storage Arbitrage

Ming Yi, Bolun Xu, Saud Alghumayjan

Potential utilization of Battery Energy Storage Systems (BESS) in the major European electricity markets

Yu Hu, Miguel Armada, Maria Jesus Sanchez

| Title | Authors | Year | Actions |

|---|

Comments (0)