Authors

Summary

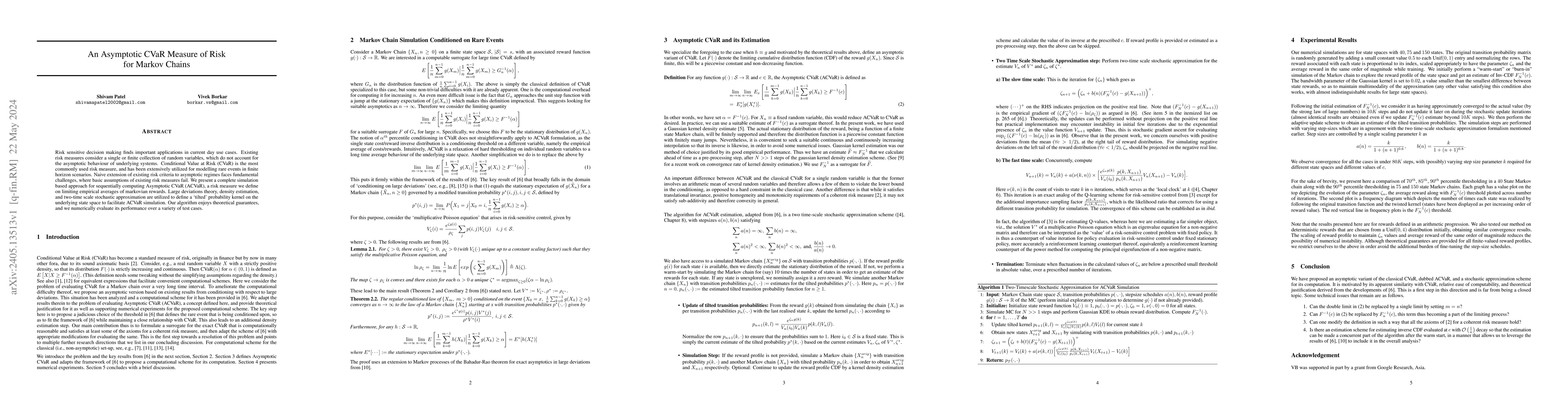

Risk sensitive decision making finds important applications in current day use cases. Existing risk measures consider a single or finite collection of random variables, which do not account for the asymptotic behaviour of underlying systems. Conditional Value at Risk (CVaR) is the most commonly used risk measure, and has been extensively utilized for modelling rare events in finite horizon scenarios. Naive extension of existing risk criteria to asymptotic regimes faces fundamental challenges, where basic assumptions of existing risk measures fail. We present a complete simulation based approach for sequentially computing Asymptotic CVaR (ACVaR), a risk measure we define on limiting empirical averages of markovian rewards. Large deviations theory, density estimation, and two-time scale stochastic approximation are utilized to define a 'tilted' probability kernel on the underlying state space to facilitate ACVaR simulation. Our algorithm enjoys theoretical guarantees, and we numerically evaluate its performance over a variety of test cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrong Converses using Change of Measure and Asymptotic Markov Chains

Mireille Sarkiss, Michèle Wigger, Mustapha Hamad

Risk-Sensitive Markov Decision Processes with Long-Run CVaR Criterion

Peter W. Glynn, Li Xia

No citations found for this paper.

Comments (0)