Authors

Summary

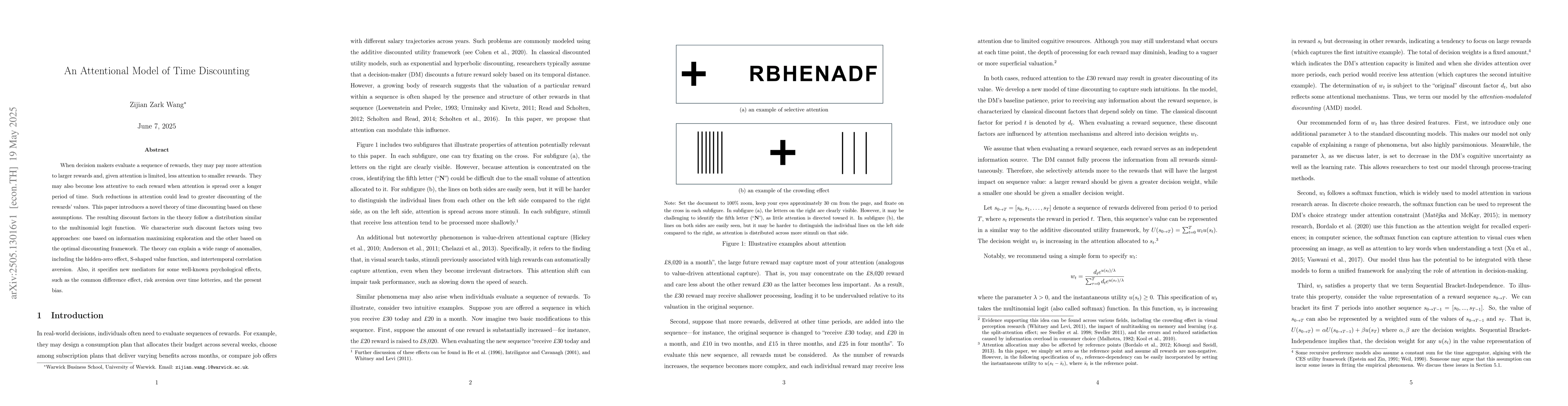

When decision makers evaluate a sequence of rewards, they may pay more attention to larger rewards and, given attention is limited, less attention to smaller rewards. They may also become less attentive to each reward when attention is spread over a longer period of time. Such reductions in attention could lead to greater discounting of the rewards' values. This paper introduces a novel theory of time discounting based on these assumptions. The resulting discount factors in the theory follow a distribution similar to the multinomial logit function. We characterize such discount factors using two approaches: one based on information maximizing exploration and the other based on the optimal discounting framework. The theory can explain a wide range of anomalies, including the hidden-zero effect, S-shaped value function, and intertemporal correlation aversion. Also, it specifies new mediators for some well-known psychological effects, such as the common difference effect, risk aversion over time lotteries, and the present bias.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper introduces a novel theory of time discounting based on attention allocation, assuming decision-makers focus more on larger rewards and less on smaller ones, with diminishing attention over time leading to greater discounting of rewards' values.

Key Results

- The discount factors in the theory follow a distribution similar to the multinomial logit function.

- The theory explains anomalies such as the hidden-zero effect, S-shaped value function, and intertemporal correlation aversion.

- New mediators are specified for psychological effects like the common difference effect, risk aversion over time lotteries, and present bias.

Significance

This research is important as it provides a comprehensive attentional model for time discounting, potentially enhancing our understanding of decision-making processes under uncertainty, with applications in economics, psychology, and behavioral finance.

Technical Contribution

The paper presents an innovative attentional model for time discounting, characterizing discount factors using information maximizing exploration and the optimal discounting framework.

Novelty

This work distinguishes itself by integrating attentional mechanisms into time discounting theory, offering explanations for various anomalies and specifying new mediators for known psychological effects.

Limitations

- The model's assumptions about attention allocation may not universally apply to all decision-making contexts.

- Empirical validation of the model's predictions is required to confirm its practical applicability.

Future Work

- Further investigation into the model's applicability across diverse decision-making scenarios.

- Development of empirical tests to validate the model's predictions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDelta Matters: An Analytically Tractable Model for $β$-$δ$ Discounting Agents

Takeshi Kurashima, Yasunori Akagi

Markov Decision Processes with Time-Varying Geometric Discounting

Debmalya Mandal, Goran Radanovic, Rupak Majumdar et al.

No citations found for this paper.

Comments (0)