Authors

Summary

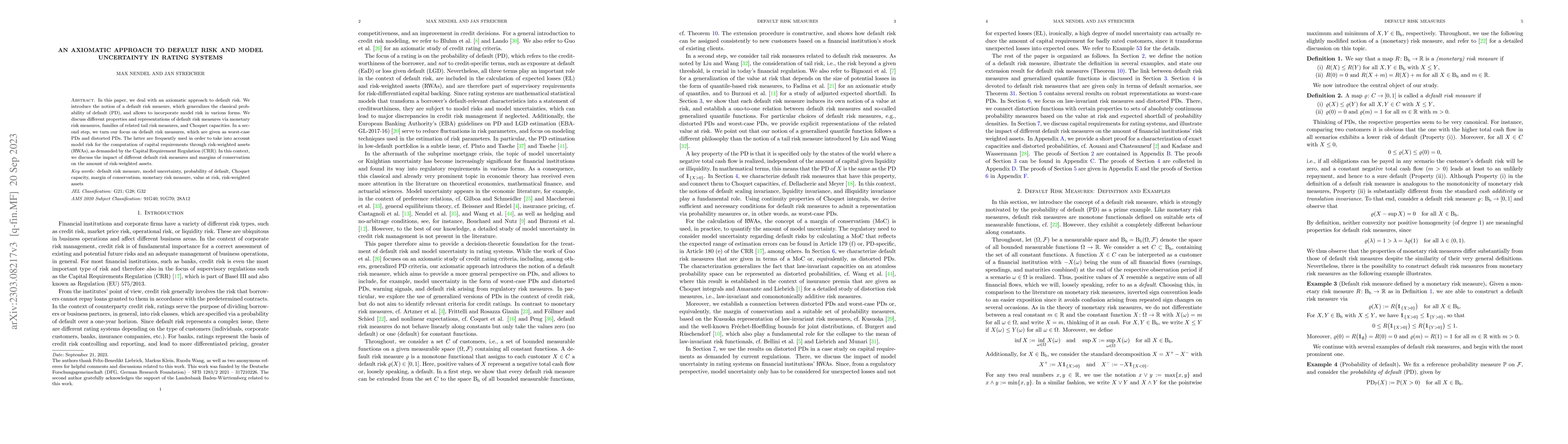

In this paper, we deal with an axiomatic approach to default risk. We introduce the notion of a default risk measure, which generalizes the classical probability of default (PD), and allows to incorporate model risk in various forms. We discuss different properties and representations of default risk measures via monetary risk measures, families of related tail risk measures, and Choquet capacities. In a second step, we turn our focus on default risk measures, which are given as worst-case PDs and distorted PDs. The latter are frequently used in order to take into account model risk for the computation of capital requirements through risk-weighted assets (RWAs), as demanded by the Capital Requirement Regulation (CRR). In this context, we discuss the impact of different default risk measures and margins of conservatism on the amount of risk-weighted assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)