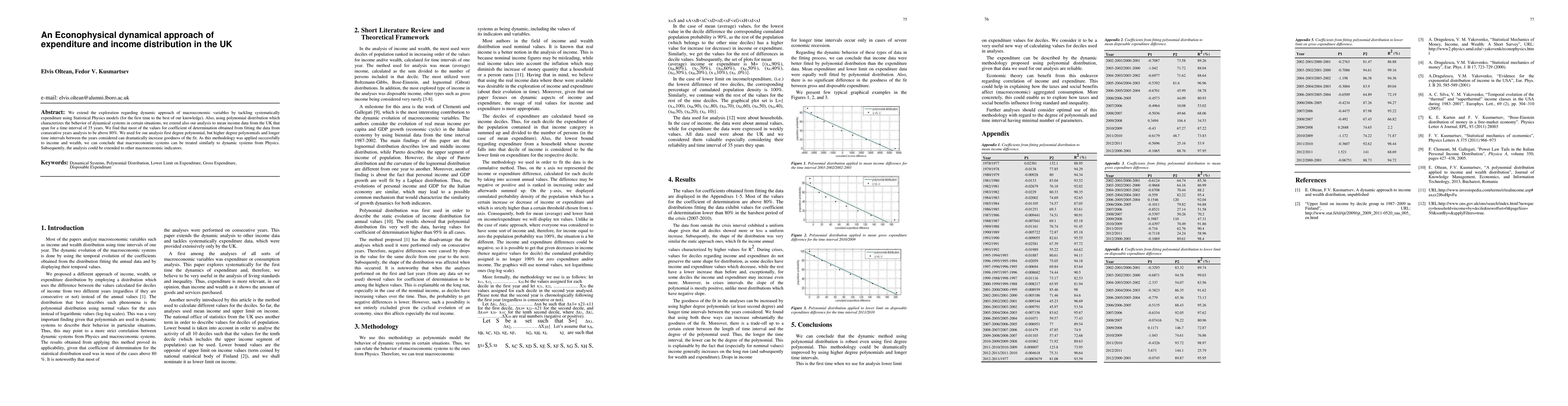

Summary

We extend the exploration regarding dynamical approach of macroeconomic variables by tackling systematically expenditure using Statistical Physics models (for the first time to the best of our knowledge). Also, using polynomial distribution which characterizes the behavior of dynamical systems in certain situations, we extend also our analysis to mean income data from the UK that span for a time interval of 35 years. We find that most of the values for coefficient of determination obtained from fitting the data from consecutive years analysis to be above 80%. We used for our analysis first degree polynomial, but higher degree polynomials and longer time intervals between the years considered can dramatically increase goodness of the fit. As this methodology was applied successfully to income and wealth, we can conclude that macroeconomic systems can be treated similarly to dynamic systems from Physics. Subsequently, the analysis could be extended to other macroeconomic indicators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)