Authors

Summary

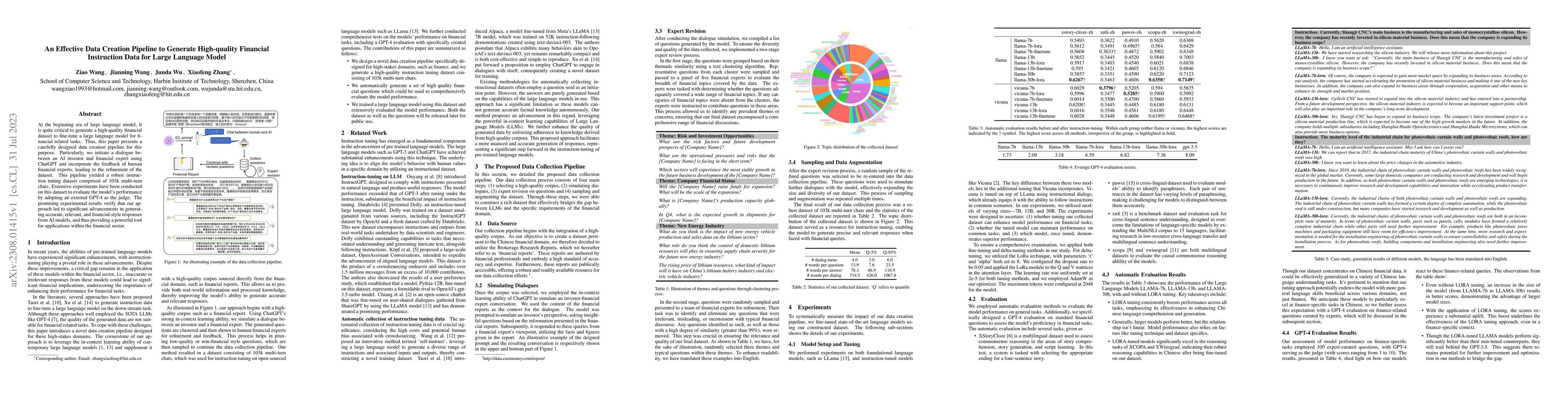

At the beginning era of large language model, it is quite critical to generate a high-quality financial dataset to fine-tune a large language model for financial related tasks. Thus, this paper presents a carefully designed data creation pipeline for this purpose. Particularly, we initiate a dialogue between an AI investor and financial expert using ChatGPT and incorporate the feedback of human financial experts, leading to the refinement of the dataset. This pipeline yielded a robust instruction tuning dataset comprised of 103k multi-turn chats. Extensive experiments have been conducted on this dataset to evaluate the model's performance by adopting an external GPT-4 as the judge. The promising experimental results verify that our approach led to significant advancements in generating accurate, relevant, and financial-style responses from AI models, and thus providing a powerful tool for applications within the financial sector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLP Data Pipeline: Lightweight, Purpose-driven Data Pipeline for Large Language Models

Chanjun Park, Sukyung Lee, Yungi Kim et al.

Scalable Vision Language Model Training via High Quality Data Curation

Chao Feng, Xiao Liang, Hongyuan Dong et al.

PIXIU: A Large Language Model, Instruction Data and Evaluation Benchmark for Finance

Jimin Huang, Qianqian Xie, Xiao Zhang et al.

No citations found for this paper.

Comments (0)