Authors

Summary

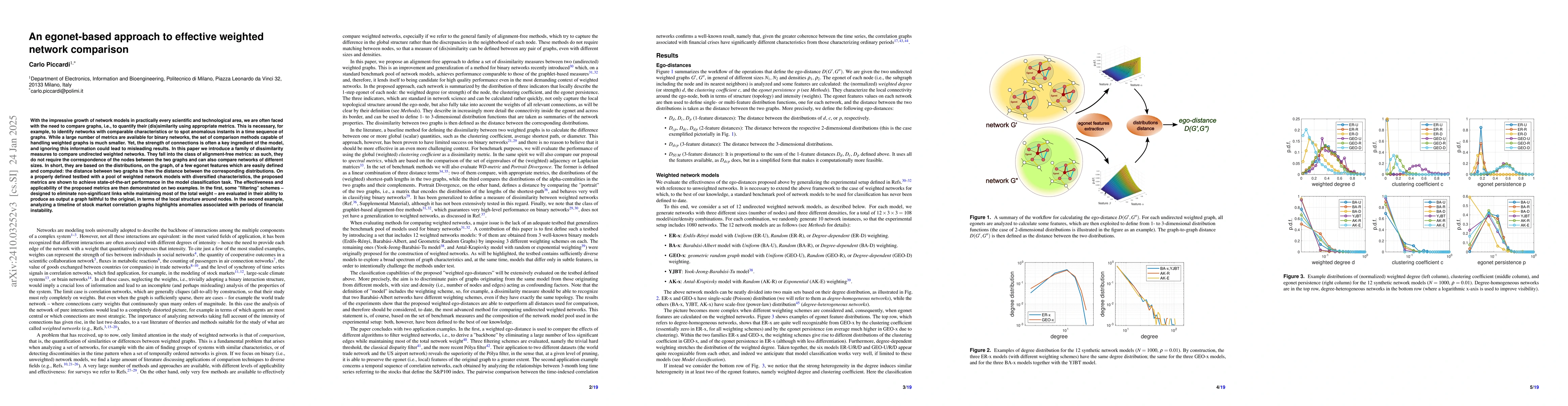

With the impressive growth of network models in practically every scientific and technological area, we are often faced with the need to compare graphs, i.e., to quantify their (dis)similarity using appropriate metrics. This is necessary, for example, to identify networks with comparable characteristics or to spot anomalous instants in a time sequence of graphs. While a large number of metrics are available for binary networks, the set of comparison methods capable of handling weighted graphs is much smaller. Yet, the strength of connections is often a key ingredient of the model, and ignoring this information could lead to misleading results. In this paper we introduce a family of dissimilarity measures to compare undirected weighted networks. They fall into the class of alignment-free metrics: as such, they do not require the correspondence of the nodes between the two graphs and can also compare networks of different sizes. In short, they are based on the distributions, on the graph, of a few egonet features which are easily defined and computed: the distance between two graphs is then the distance between the corresponding distributions. On a properly defined testbed with a pool of weighted network models with diversified characteristics, the proposed metrics are shown to achieve state-of-the-art performance in the model classification task. The effectiveness and applicability of the proposed metrics are then demonstrated on two examples. In the first, some "filtering" schemes -- designed to eliminate non-significant links while maintaining most of the total weight -- are evaluated in their ability to produce as output a graph faithful to the original, in terms of the local structure around nodes. In the second example, analyzing a timeline of stock market correlation graphs highlights anomalies associated with periods of financial instability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTemporal Egonet Subgraph Transitions

Daniel Gonzalez Cedre, Sophia Abraham, Lucas Parzianello et al.

No citations found for this paper.

Comments (0)