Authors

Summary

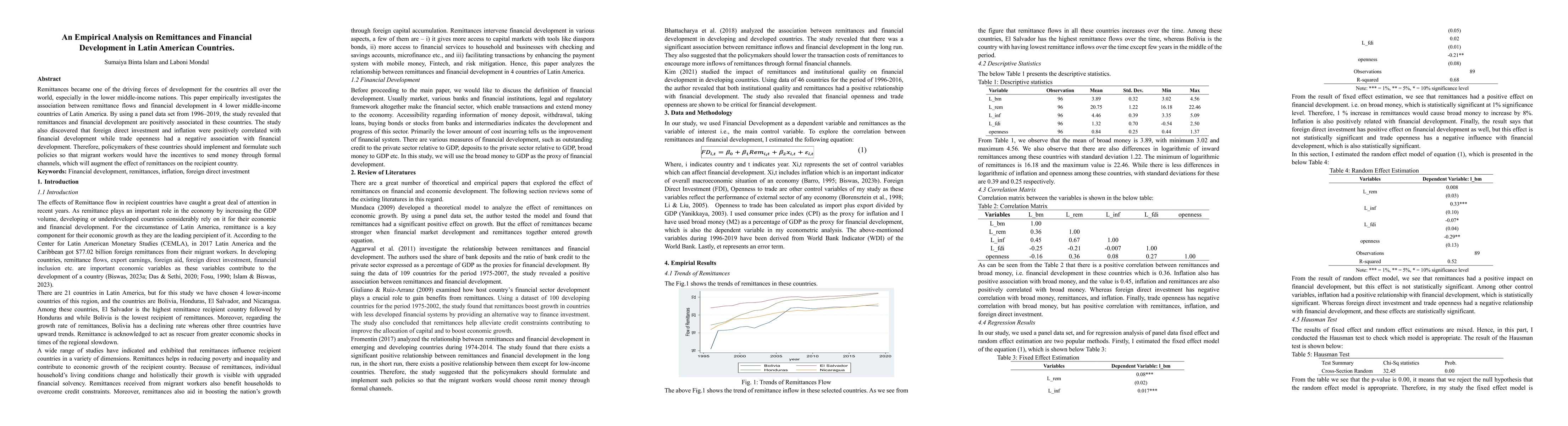

Remittances have become one of the driving forces of development for countries all over the world, especially in lower-middle-income nations. This paper empirically investigates the association between remittance flows and financial development in 4 lower-middle-income countries of Latin America. By using a panel data set from 1996 to 2019, the study revealed that remittances and financial development are positively associated in these countries. The study also discovered that foreign direct investment and inflation were positively correlated with financial development while trade openness had a negative association with financial development. Therefore, policymakers of these countries should implement and formulate such policies so that migrant workers would have the incentives to send money through formal channels, which will augment the effect of remittances on the recipient country.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCancer genomics and bioinformatics in Latin American countries: applications, challenges, and perspectives.

Torres-Narvaez, Erika Sofia, Mendivelso-González, Daniel Felipe, Artunduaga-Alvarado, Juan Andrés et al.

International Registry of thyroid cancer in Latin American (CaTaLiNA): epidemiology, clinical and follow-up study protocol in Latin American countries during the period 2023-2028.

Solis Pazmino, Paola, Pilatuna, Eduardo, Ron, Mario et al.

Democratising Artificial Intelligence for Pandemic Preparedness and Global Governance in Latin American and Caribbean Countries

Peter F. Stadler, Andre de Carvalho, Robson Bonidia et al.

No citations found for this paper.

Comments (0)