Authors

Summary

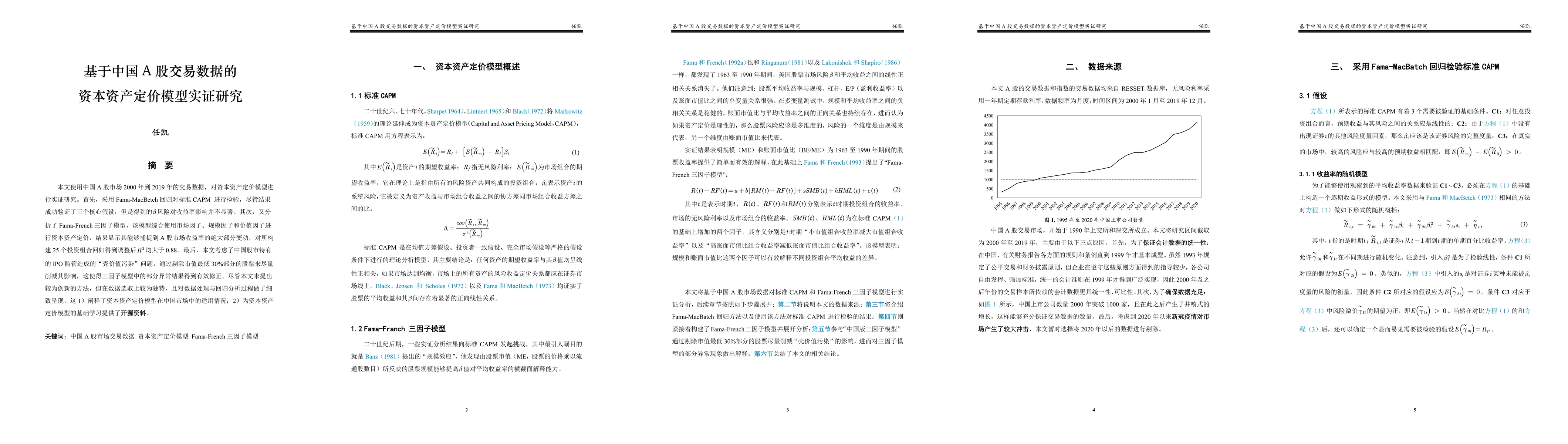

This paper presents an empirical analysis of the capital asset pricing model using trading data for the Chinese A-share market from 2000 to 2019. Firstly, the standard CAPM is tested using a Fama-MacBetch regression and although the results successfully test the three core hypotheses, the resulting beta risk does not have a significant impact on returns. Secondly, the Fama-French three-factor model, which uses a combination of market, size and value factors to price capital assets, is analysed, showing that it is able to capture most of the variation in A-share market returns, with an adjusted R-squared greater than 0.88 for the 25 portfolios constructed. Finally, the paper takes into account the "shell value contamination" problem caused by IPO regulation in the Chinese stock market, and minimises its impact by excluding stocks in the lowest 30% of the market capitalisation, which allows some of the anomalous results in the three-factor model to be effectively corrected. Although this paper does not present a more innovative approach, it is unique in its data selection and presents a detailed presentation of the data processing and regression analysis process, which 1) illustrates the applicability of capital asset pricing models in the Chinese market; and 2) provides a set of open source materials for the basic learning of capital asset pricing models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersStock Return Prediction based on a Functional Capital Asset Pricing Model

Han Lin Shang, Ufuk Beyaztas, Kaiying Ji et al.

No citations found for this paper.

Comments (0)