Authors

Summary

This project introduces an end-to-end trading system that leverages Large Language Models (LLMs) for real-time market sentiment analysis. By synthesizing data from financial news and social media, the system integrates sentiment-driven insights with technical indicators to generate actionable trading signals. FinGPT serves as the primary model for sentiment analysis, ensuring domain-specific accuracy, while Kubernetes is used for scalable and efficient deployment.

AI Key Findings

Generated Jun 12, 2025

Methodology

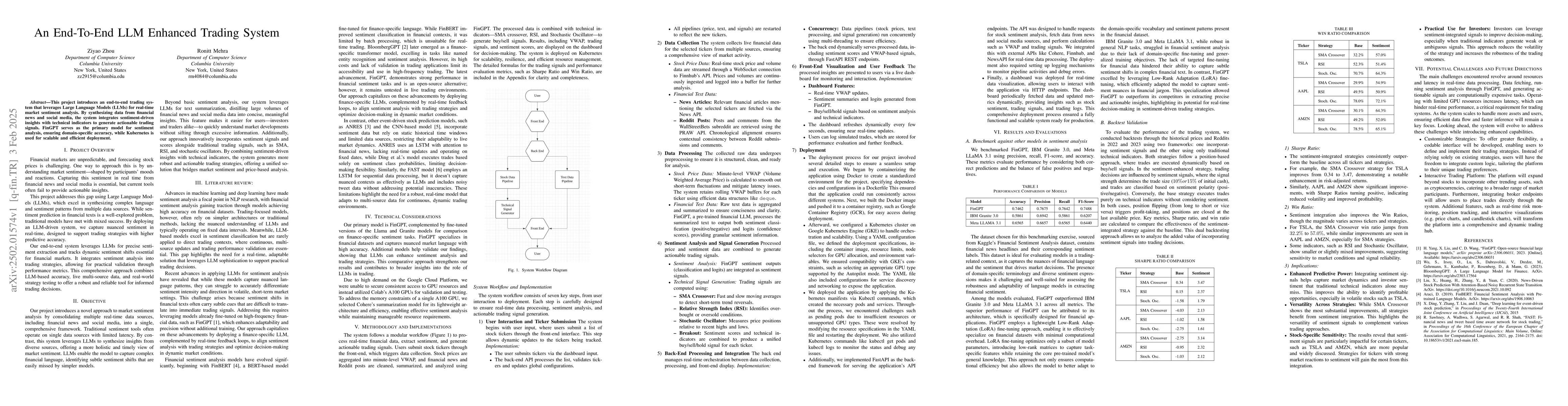

The research implements a modular workflow for real-time financial data processing, sentiment analysis, and generation of actionable trading signals. It involves collecting live stock price and textual data from multiple sources, preprocessing the data, performing sentiment analysis using FinGPT, combining processed data with technical indicators, and generating trading signals. The system is deployed on Kubernetes for scalability and efficient resource management.

Key Results

- FinGPT outperformed IBM Granite3.0 and MetaLLAMA3.1 in financial sentiment analysis tasks, demonstrating superior accuracy, precision, recall, and F1-score.

- Sentiment-integrated trading strategies consistently outperformed baseline strategies using only technical indicators, as measured by Sharpe Ratio and Win Ratio.

- The system showed significant improvements in risk-adjusted returns and profitability for stocks like TSLA, AAPL, and AMZN, indicating enhanced predictive power and stock-specific sensitivity.

Significance

This research is important as it presents an end-to-end trading system that leverages Large Language Models (LLMs) for real-time market sentiment analysis, integrating sentiment-driven insights with technical indicators to generate actionable trading signals.

Technical Contribution

The research introduces an innovative trading system that combines real-time financial data processing, sentiment analysis using FinGPT, and technical indicators to generate trading signals, deployed on Kubernetes for scalability.

Novelty

This work stands out by employing fine-tuned finance-specific LLMs (FinGPT) for real-time sentiment analysis, complemented by real-time feedback loops, to align sentiment analysis with trading strategies and optimize decision-making in dynamic market conditions.

Limitations

- The study faced resource and latency challenges in real-time data processing due to computationally expensive tasks like data fetching, sentiment analysis using FinGPT, and signal generation.

- Limited GPU resources increased latency, which could hinder real-time performance, a critical requirement for trading systems.

Future Work

- Develop a customizable strategy interface to enable users to define and implement their trading strategies, integrating custom logic tailored to their preferences.

- Expand the platform beyond stocks to incorporate other trending assets like cryptocurrencies, catering to a broader range of market participants and integrating broker endpoints for direct trading.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning for Options Trading: An End-To-End Approach

Wee Ling Tan, Stephen Roberts, Stefan Zohren

LeAD: The LLM Enhanced Planning System Converged with End-to-end Autonomous Driving

Jian Sun, Jiaqi Liu, Yuhang Zhang et al.

No citations found for this paper.

Comments (0)