Authors

Summary

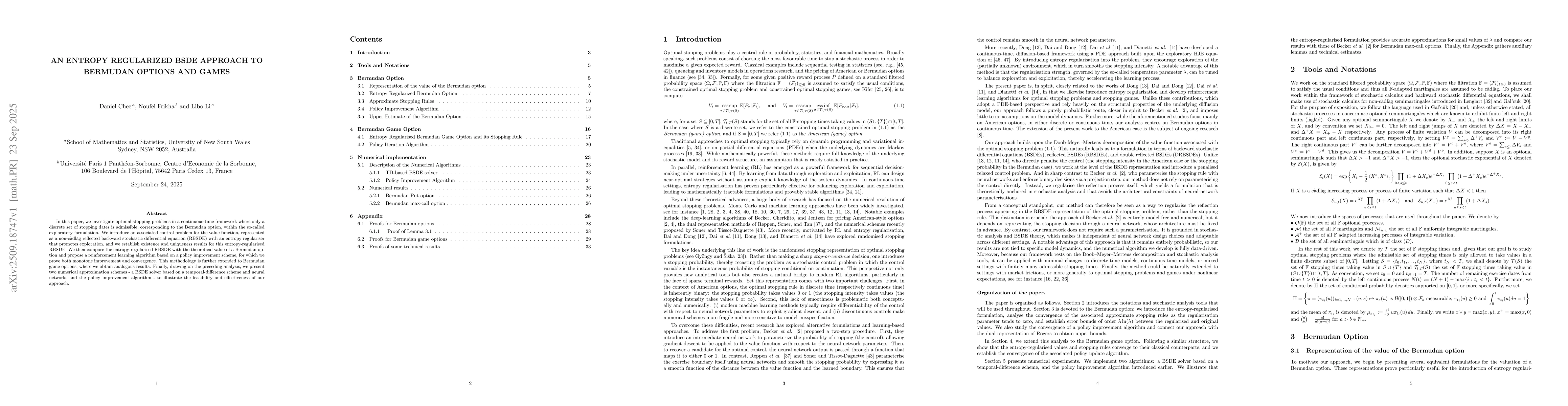

In this paper, we investigate optimal stopping problems in a continuous-time framework where only a discrete set of stopping dates is admissible, corresponding to the Bermudan option, within the so-called exploratory formulation. We introduce an associated control problem for the value function, represented as a non-c\`adl\`ag reflected backward stochastic differential equation (RBSDE) with an entropy regulariser that promotes exploration, and we establish existence and uniqueness results for this entropy-regularised RBSDE. We then compare the entropy-regularised RBSDE with the theoretical value of a Bermudan option and propose a reinforcement learning algorithm based on a policy improvement scheme, for which we prove both monotone improvement and convergence. This methodology is further extended to Bermudan game options, where we obtain analogous results. Finally, drawing on the preceding analysis, we present two numerical approximation schemes - a BSDE solver based on a temporal-difference scheme and neural networks and the policy improvement algorithm - to illustrate the feasibility and effectiveness of our approach.

AI Key Findings

Generated Sep 29, 2025

Methodology

The research employs a deep learning approach combined with backward stochastic differential equations (BSDEs) to solve high-dimensional optimal stopping problems, particularly for pricing and hedging Bermudan options. It utilizes neural networks to approximate the solution to the associated BSDEs and incorporates a dual approach for hedging.

Key Results

- The method achieves accurate pricing of Bermudan options in high-dimensional settings with reduced computational complexity compared to traditional Monte Carlo methods.

- The dual approach enables efficient hedging strategies by approximating the optimal stopping time and associated risk exposure.

- Experiments demonstrate the effectiveness of the framework in handling complex financial instruments with multiple exercise opportunities.

Significance

This research advances the field of financial mathematics by providing a scalable and computationally efficient method for pricing and hedging complex derivatives. It addresses the longstanding challenge of high-dimensional optimal stopping problems, which are critical in modern financial markets.

Technical Contribution

The paper introduces a novel combination of deep learning and BSDEs to solve optimal stopping problems, with a specific focus on Bermudan options. It also presents a dual approach for hedging that enhances the practical applicability of the method.

Novelty

This work is novel in its integration of deep learning with BSDEs for optimal stopping problems and its dual approach to hedging, which provides both pricing and risk management capabilities in a unified framework.

Limitations

- The method's performance depends heavily on the quality and quantity of training data, which may be limited in real-world applications.

- The computational cost for very high-dimensional problems may still be prohibitive despite the efficiency gains.

Future Work

- Exploring the integration of reinforcement learning techniques to further optimize the stopping strategies.

- Extending the framework to handle path-dependent options and more complex market models.

- Investigating the use of more advanced neural network architectures to improve approximation accuracy.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA deep BSDE approach for the simultaneous pricing and delta-gamma hedging of large portfolios consisting of high-dimensional multi-asset Bermudan options

Cornelis W. Oosterlee, Balint Negyesi

A pure dual approach for hedging Bermudan options

Ahmed Kebaier, Aurélien Alfonsi, Jérôme Lelong

Comments (0)