Summary

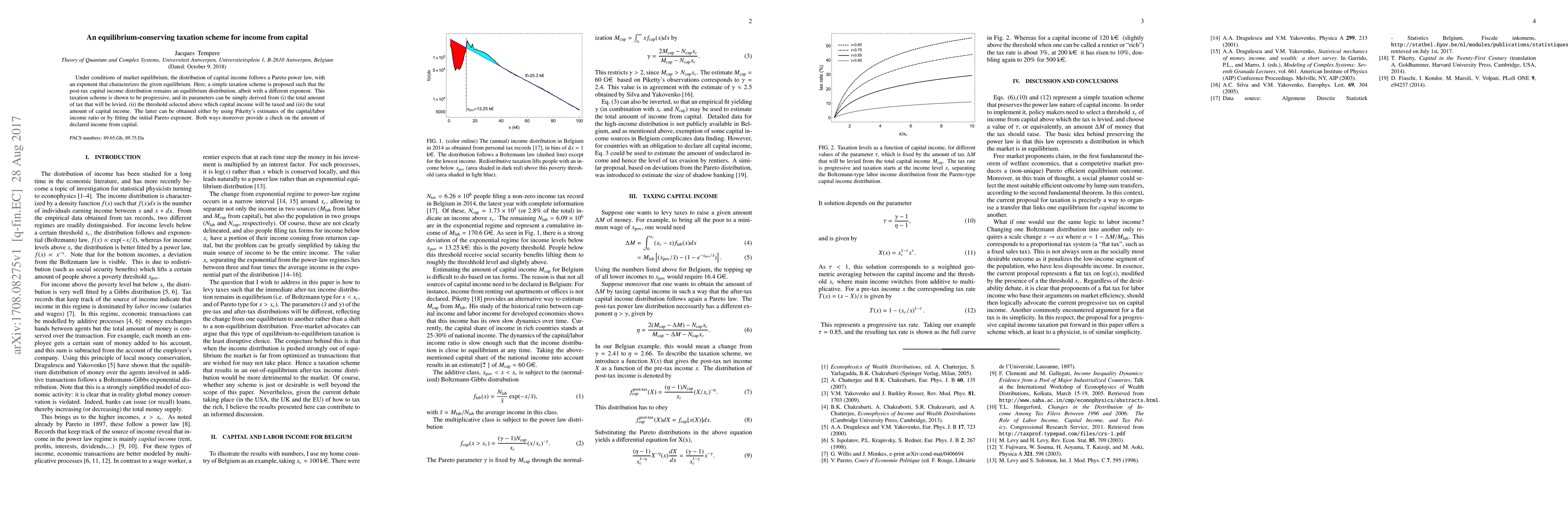

Under conditions of market equilibrium, the distribution of capital income follows a Pareto power law, with an exponent that characterizes the given equilibrium. Here, a simple taxation scheme is proposed such that the post-tax capital income distribution remains an equilibrium distribution, albeit with a different exponent. This taxation scheme is shown to be progressive, and its parameters can be simply derived from (i) the total amount of tax that will be levied, (ii) the threshold selected above which capital income will be taxed and (iii) the total amount of capital income. The latter can be obtained either by using Piketty's estimates of the capital/labor income ratio or by fitting the initial Pareto exponent. Both ways moreover provide a check on the amount of declared income from capital.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersAutomation and Taxation

Kerstin Hötte, Pantelis Koutroumpis, Angelos Theodorakopoulos

Optimal taxation and the Domar-Musgrave effect

Alexis Akira Toda, Brendan K. Beare

No citations found for this paper.

Comments (0)