Authors

Summary

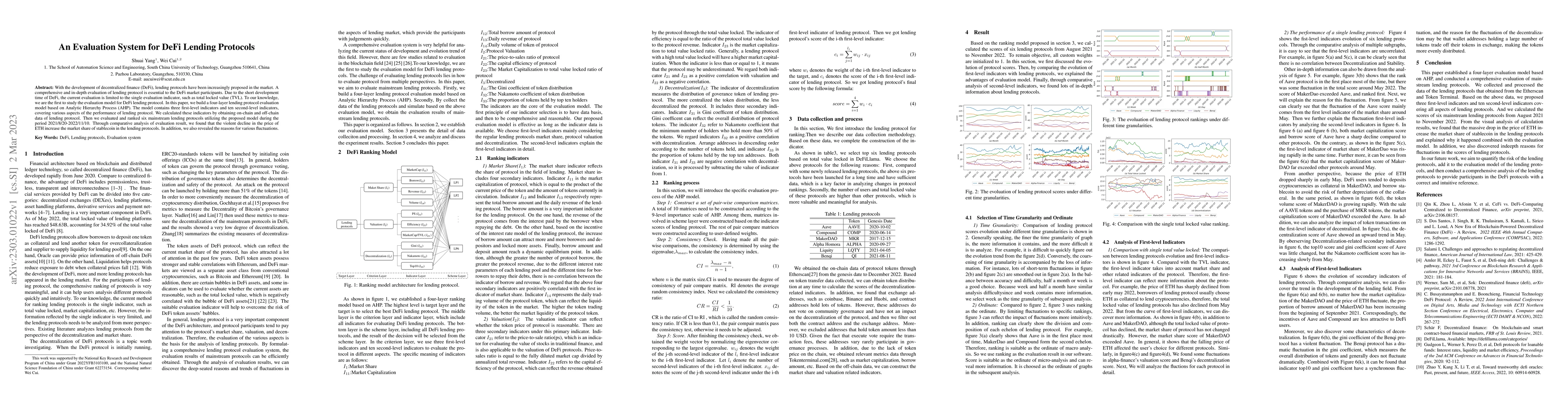

With the development of decentralized finance (DeFi), lending protocols have been increasingly proposed in the market. A comprehensive and in-depth evaluation of lending protocol is essential to the DeFi market participants. Due to the short development time of DeFi, the current evaluation is limited to the single evaluation indicator, such as total locked value (TVL). To our knowledge, we are the first to study the evaluation model for DeFi lending protocol. In this paper, we build a four-layer lending protocol evaluation model based on Analytic Hierarchy Process (AHP). The model contains three first-level indicators and ten second-level indicators, covering various aspects of the performance of lending protocol. We calculated these indicators by obtaining on-chain and off-chain data of lending protocol. Then we evaluated and ranked six mainstream lending protocols utilizing the proposed model during the period 2021/8/20-2022/11/10. Through comparative analysis of evaluation result, we found that the violent decline in the price of ETH increase the market share of stablecoin in the lending protocols. In addition, we also revealed the reasons for various fluctuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom banks to DeFi: the evolution of the lending market

Jiahua Xu, Nikhil Vadgama

DeFi Lending During The Merge

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

No citations found for this paper.

Comments (0)