Summary

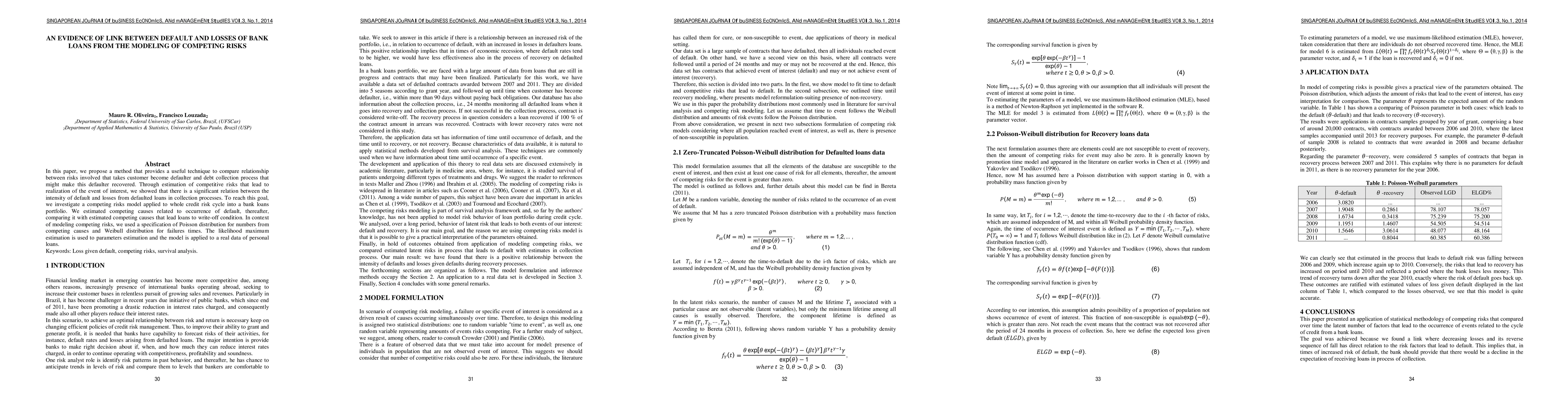

In this paper, we propose a method that provides a useful technique to compare relationship between risks involved that takes customer become defaulter and debt collection process that might make this defaulter recovered. Through estimation of competitive risks that lead to realization of the event of interest, we showed that there is a significant relation between the intensity of default and losses from defaulted loans in collection processes. To reach this goal, we investigate a competing risks model applied to whole credit risk cycle into a bank loans portfolio. We estimated competing causes related to occurrence of default, thereafter, comparing it with estimated competing causes that lead loans to write-off condition. In context of modeling competing risks, we used a specification of Poisson distribution for numbers from competing causes and Weibull distribution for failures times. The likelihood maximum estimation is used to parameters estimation and the model is applied to a real data of personal loans

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)