Authors

Summary

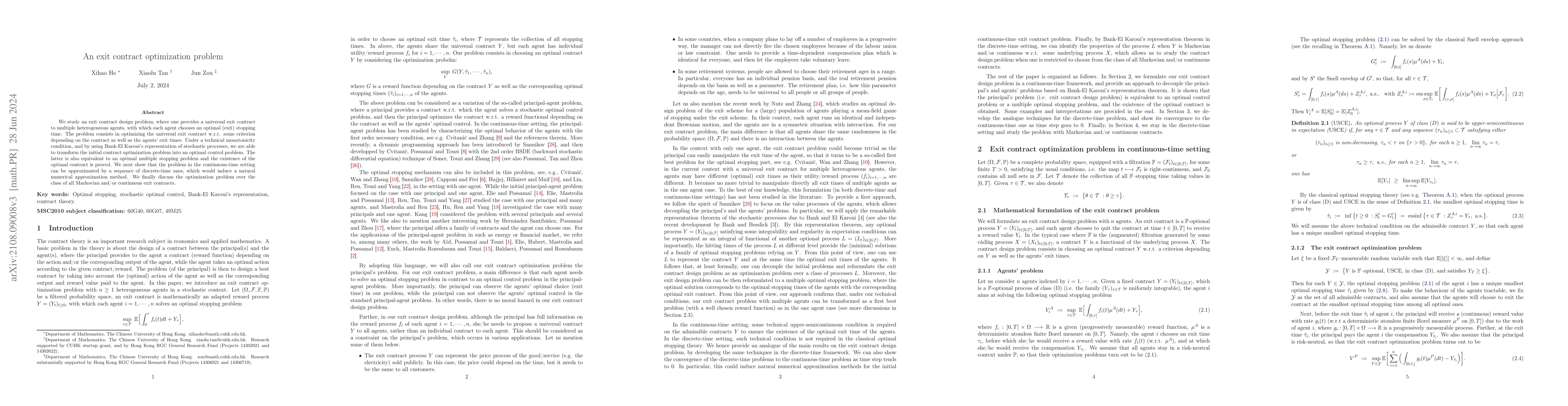

We study an exit contract design problem, where one provides a universal exit contract to multiple heterogeneous agents, with which each agent chooses an optimal (exit) stopping time. The problem consists in optimizing the universal exit contract w.r.t. some criterion depending on the contract as well as the agents' exit times. Under a technical monotonicity condition, and by using Bank-El Karoui's representation of stochastic processes, we are able to transform the initial contract optimization problem into an optimal control problem. The latter is also equivalent to an optimal multiple stopping problem and the existence of the optimal contract is proved. We next show that the problem in the continuous-time setting can be approximated by a sequence of discrete-time ones, which would induce a natural numerical approximation method. We finally discuss the optimaization problem over the class of all Markovian and/or continuous exit contracts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)