Authors

Summary

This study explores the potential of large language models (LLMs) to conduct market experiments, aiming to understand their capability to comprehend competitive market dynamics. We model the behavior of market agents in a controlled experimental setting, assessing their ability to converge toward competitive equilibria. The results reveal the challenges current LLMs face in replicating the dynamic decision-making processes characteristic of human trading behavior. Unlike humans, LLMs lacked the capacity to achieve market equilibrium. The research demonstrates that while LLMs provide a valuable tool for scalable and reproducible market simulations, their current limitations necessitate further advancements to fully capture the complexities of market behavior. Future work that enhances dynamic learning capabilities and incorporates elements of behavioral economics could improve the effectiveness of LLMs in the economic domain, providing new insights into market dynamics and aiding in the refinement of economic policies.

AI Key Findings

Generated Sep 02, 2025

Methodology

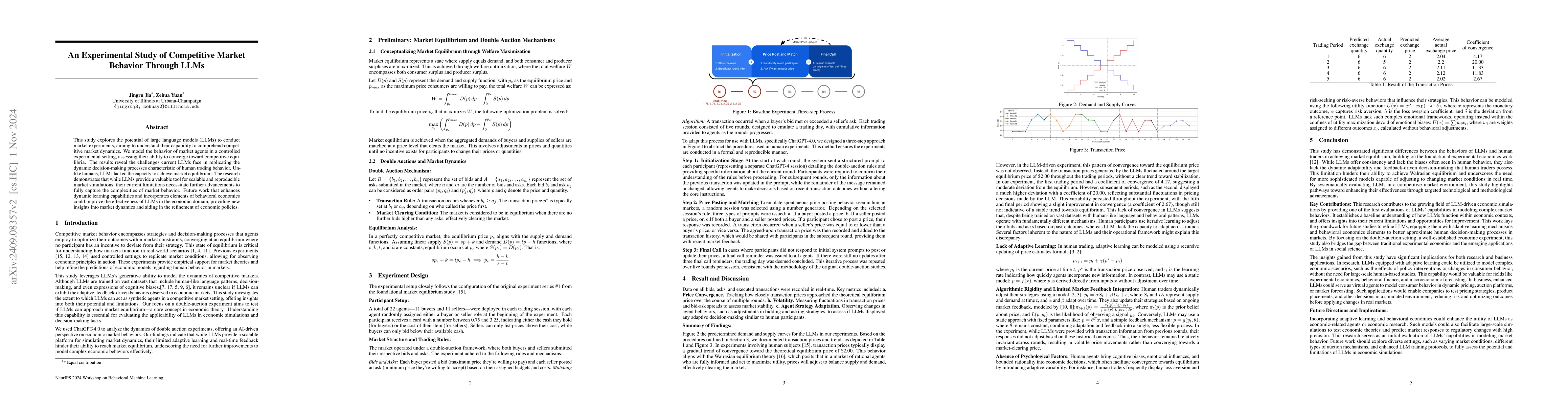

The study used an experimental setup based on the original double-auction study, involving 22 agents (11 buyers and 11 sellers) in each trading session. Each participant received a card indicating their cash (for buyers) or cost (for sellers), and the market operated under a double-auction framework where both buyers and sellers submitted bids and asks. The experiment was conducted over five rounds per session, with LLMs (ChatGPT-4.0) simulating human-like trading behavior through a three-step process: Initialization, Price Posting and Matching, and Final Call.

Key Results

- LLMs failed to converge towards the theoretical equilibrium price, unlike human participants in similar experiments.

- Transaction prices generated by LLMs fluctuated around the target equilibrium price without a clear trend towards stabilization.

- LLMs displayed limited adaptive decision-making, unlike human traders who adjust strategies based on past outcomes.

- The absence of psychological factors in LLMs, such as cognitive biases and emotional influences, contributed to their inability to converge towards equilibrium.

Significance

This research highlights the potential of LLMs in scalable and reproducible market simulations, while also identifying their current limitations in capturing the complexities of market behavior, such as dynamic decision-making processes and adaptive learning.

Technical Contribution

The study establishes a baseline understanding of LLMs' functioning within economic contexts and offers insights into their current limitations, paving the way for refining LLMs to better model complex market behaviors.

Novelty

This research is one of the first evaluations of LLMs' capabilities in modeling complex market behaviors and bridges the gap between traditional experimental economics and the emerging applications of LLMs in social sciences.

Limitations

- Current LLMs lack the capacity to achieve market equilibrium due to the absence of adaptive learning and feedback-driven decision-making mechanisms.

- LLMs operate with fundamentally different mechanisms compared to human traders, failing to incorporate psychological factors and bounded rationality.

Future Work

- Enhance dynamic learning capabilities and incorporate elements of behavioral economics to improve LLMs' effectiveness in the economic domain.

- Explore the integration of adaptive learning mechanisms and behavioral economics elements to better approximate human decision-making processes in markets.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)