Summary

By investigating model-independent bounds for exotic options in financial mathematics, a martingale version of the Monge-Kantorovich mass transport problem was introduced in \cite{BeiglbockHenry LaborderePenkner,GalichonHenry-LabordereTouzi}. In this paper, we extend the one-dimensional Brenier's theorem to the present martingale version. We provide the explicit martingale optimal transference plans for a remarkable class of coupling functions corresponding to the lower and upper bounds. These explicit extremal probability measures coincide with the unique left and right monotone martingale transference plans, which were introduced in \cite{BeiglbockJuillet} by suitable adaptation of the notion of cyclic monotonicity. Instead, our approach relies heavily on the (weak) duality result stated in \cite{BeiglbockHenry-LaborderePenkner}, and provides, as a by-product, an explicit expression for the corresponding optimal semi-static hedging strategies. We finally provide an extension to the multiple marginals case.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

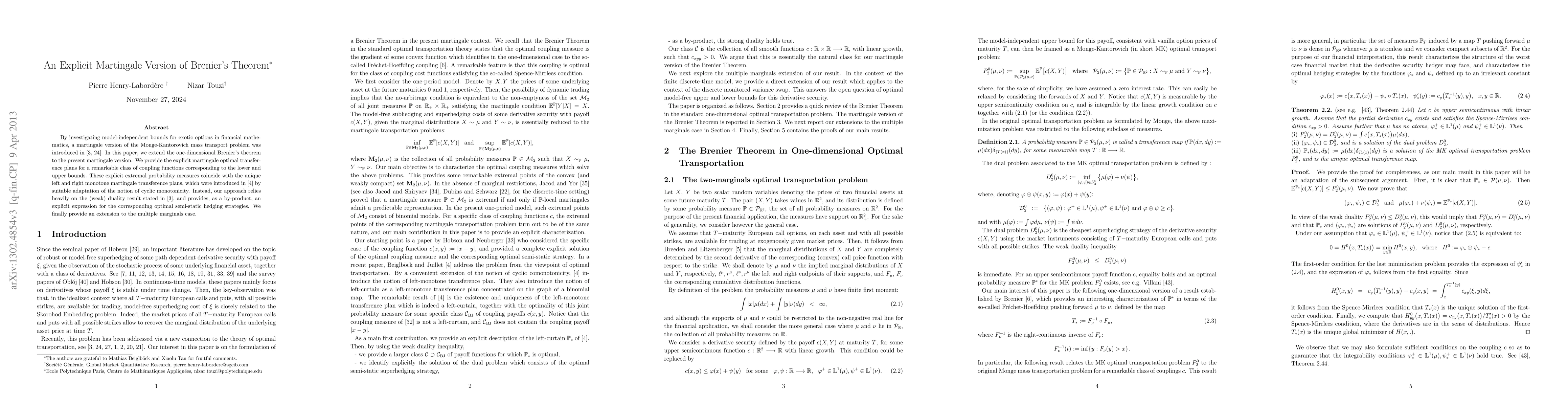

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSupermartingale Brenier's Theorem with full-marginals constraint

Erhan Bayraktar, Dominykas Norgilas, Shuoqing Deng

An explicit version of Chen's theorem

Matteo Bordignon, Daniel R. Johnston, Valeriia Starichkova

A composite generalization of Ville's martingale theorem

Aaditya Ramdas, Martin Larsson, Johannes Ruf et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)