Summary

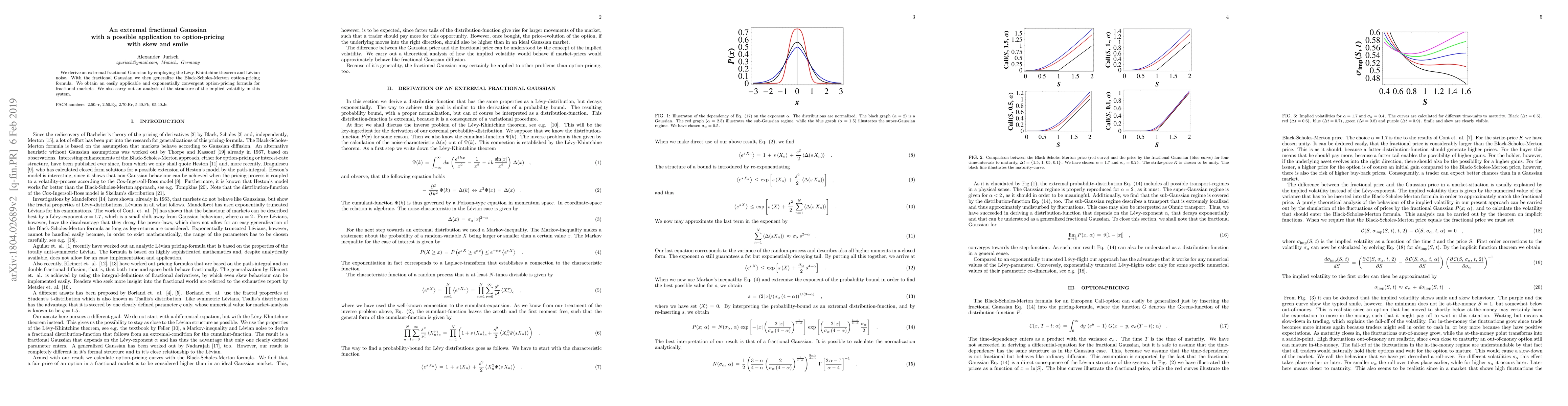

We derive an extremal fractional Gaussian by employing the L\'evy-Khintchine theorem and L\'evian noise. With the fractional Gaussian we then generalize the Black-Scholes-Merton option-pricing formula. We obtain an easily applicable and exponentially convergent option-pricing formula for fractional markets. We also carry out an analysis of the structure of the implied volatility in this system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalytic RFR Option Pricing with Smile and Skew

Aurelio Romero-Bermúdez, Colin Turfus

| Title | Authors | Year | Actions |

|---|

Comments (0)