Authors

Summary

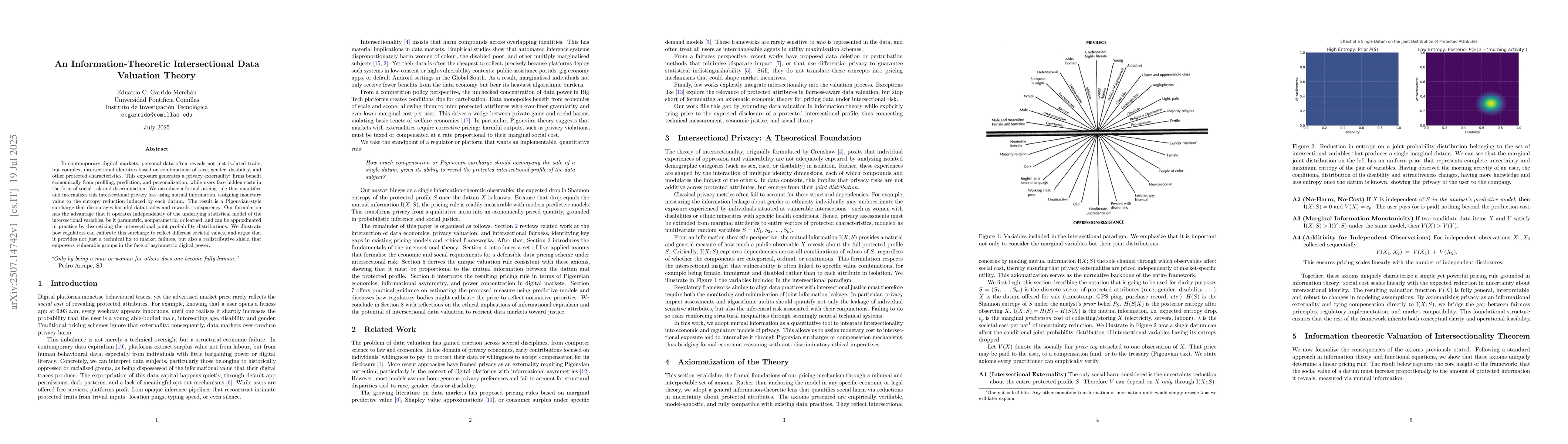

In contemporary digital markets, personal data often reveals not just isolated traits, but complex, intersectional identities based on combinations of race, gender, disability, and other protected characteristics. This exposure generates a privacy externality: firms benefit economically from profiling, prediction, and personalization, while users face hidden costs in the form of social risk and discrimination. We introduce a formal pricing rule that quantifies and internalizes this intersectional privacy loss using mutual information, assigning monetary value to the entropy reduction induced by each datum. The result is a Pigouvian-style surcharge that discourages harmful data trades and rewards transparency. Our formulation has the advantage that it operates independently of the underlying statistical model of the intersectional variables, be it parametric, nonparametric, or learned, and can be approximated in practice by discretizing the intersectional joint probability distributions. We illustrate how regulators can calibrate this surcharge to reflect different societal values, and argue that it provides not just a technical fix to market failures, but also a redistributive shield that empowers vulnerable groups in the face of asymmetric digital power.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersInfoFair: Information-Theoretic Intersectional Fairness

Ross Maciejewski, Jian Kang, Hanghang Tong et al.

An Information-Theoretic Approach to Generalization Theory

Borja Rodríguez-Gálvez, Ragnar Thobaben, Mikael Skoglund

Data Valuation by Leveraging Global and Local Statistical Information

Hao Jiang, Xiaoling Zhou, Ou Wu et al.

Comments (0)