Summary

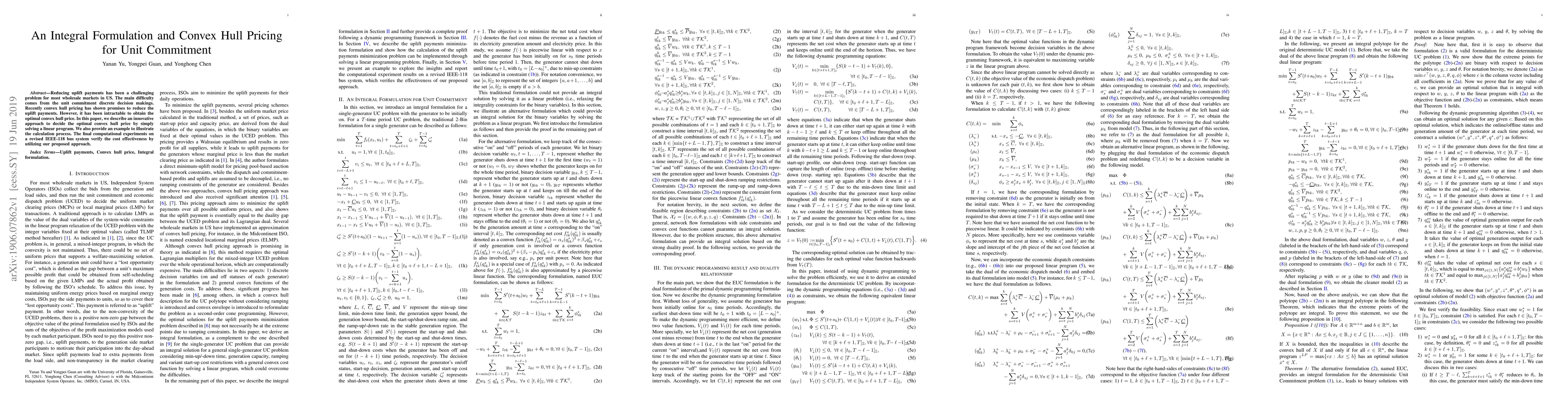

Reducing uplift payments has been a challenging problem for most wholesale markets in US. The main difficulty comes from the unit commitment discrete decision makings. Recently convex hull pricing has shown promises to reduce the uplift payments. However, it has been intractable to obtain the optimal convex hull price. In this paper, we describe an innovative approach to decide the optimal convex hull price by simply solving a linear program. We also provide an example to illustrate the calculation process. The final computational experiments on a revised IEEE-118 bus system verify the cost effectiveness by utilizing our proposed approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNovel Quality Measure and Efficient Resolution of Convex Hull Pricing for Unit Commitment

Feng Zhao, Mikhail A. Bragin, Bing Yan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)