Summary

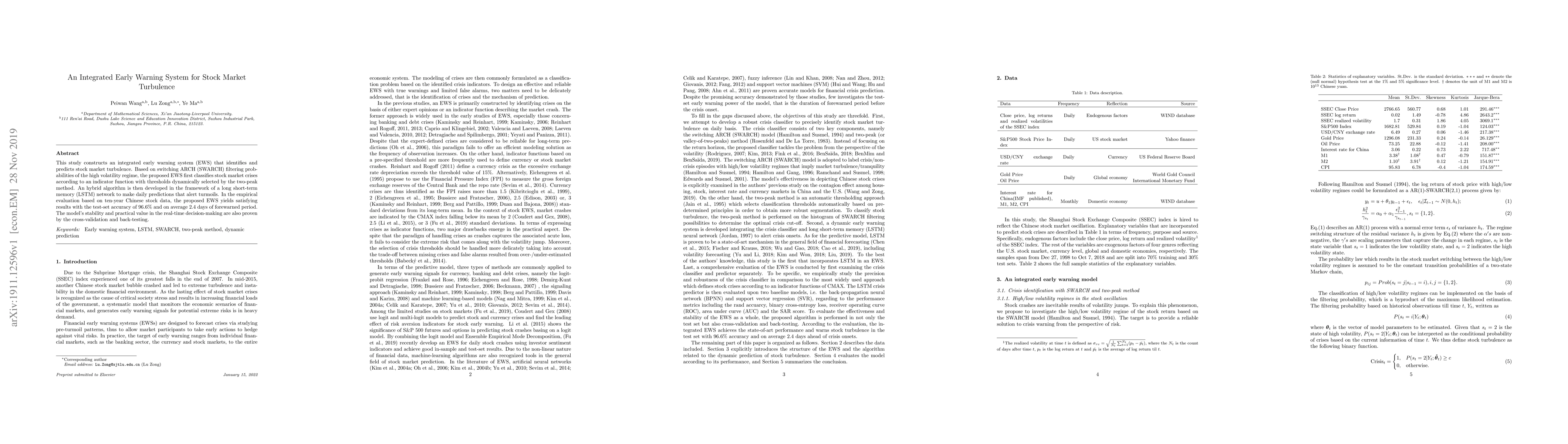

This study constructs an integrated early warning system (EWS) that identifies and predicts stock market turbulence. Based on switching ARCH (SWARCH) filtering probabilities of the high volatility regime, the proposed EWS first classifies stock market crises according to an indicator function with thresholds dynamically selected by the two-peak method. A hybrid algorithm is then developed in the framework of a long short-term memory (LSTM) network to make daily predictions that alert turmoils. In the empirical evaluation based on ten-year Chinese stock data, the proposed EWS yields satisfying results with the test-set accuracy of $96.6\%$ and on average $2.4$ days of the forewarned period. The model's stability and practical value in real-time decision-making are also proven by the cross-validation and back-testing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCrowd-Funded Earthquake Early-Warning System

Hsi-Jen James Yeh, Hudson Kaleb Dy

| Title | Authors | Year | Actions |

|---|

Comments (0)