Authors

Summary

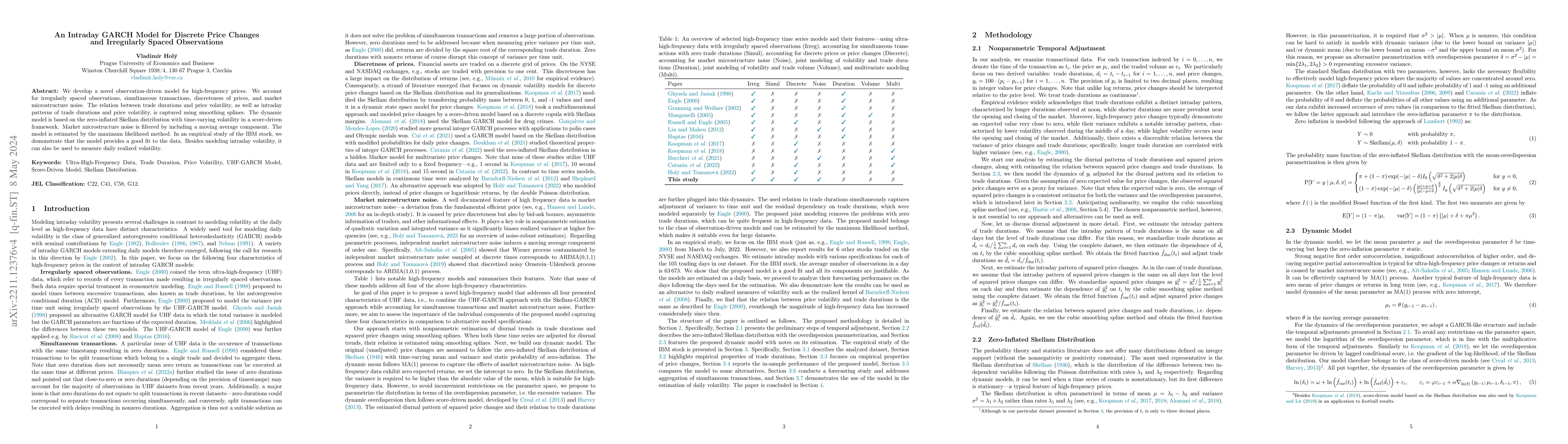

We develop a novel observation-driven model for high-frequency prices. We account for irregularly spaced observations, simultaneous transactions, discreteness of prices, and market microstructure noise. The relation between trade durations and price volatility, as well as intraday patterns of trade durations and price volatility, is captured using smoothing splines. The dynamic model is based on the zero-inflated Skellam distribution with time-varying volatility in a score-driven framework. Market microstructure noise is filtered by including a moving average component. The model is estimated by the maximum likelihood method. In an empirical study of the IBM stock, we demonstrate that the model provides a good fit to the data. Besides modeling intraday volatility, it can also be used to measure daily realized volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling Multiple Irregularly Spaced Financial Time Series

Sumanta Basu, Chiranjit Dutta, Nalini Ravishanker

No citations found for this paper.

Comments (0)