Authors

Summary

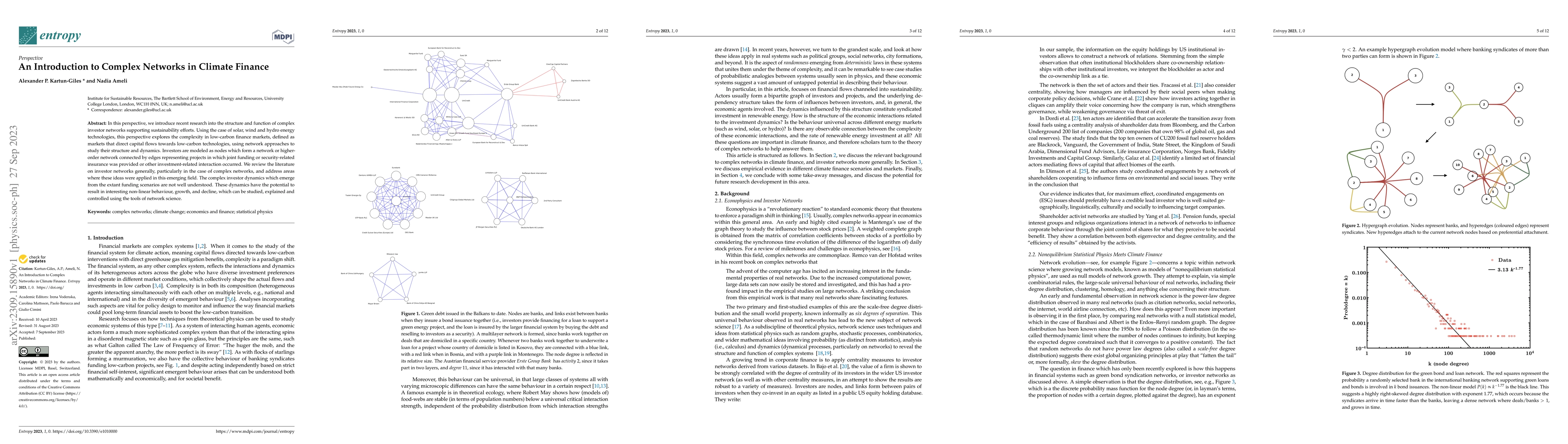

In this perspective, we introduce recent research into the structure and function of complex investor networks supporting sustainability efforts. Using the case of solar, wind and hydro energy technologies, this perspective explores the complexity in low-carbon finance markets, defined as markets that direct capital flows towards low-carbon technologies, using network approaches to study their structure and dynamics. Investors are modeled as nodes which form a network or higher-order network connected by edges representing projects in which joint funding or security-related insurance was provided or other investment-related interaction occurred. We review the literature on investor networks generally, particularly in the case of complex networks, and address areas where these ideas were applied in this emerging field. The complex investor dynamics which emerge from the extant funding scenarios are not well understood. These dynamics have the potential to result in interesting non-linear behaviour, growth, and decline, which can be studied, explained and controlled using the tools of network science.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternational Multilateral Public Climate Finance Dataset from 2000 to 2023.

Wang, Can, Fan, Shuting, Zhong, Hanying et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)