Authors

Summary

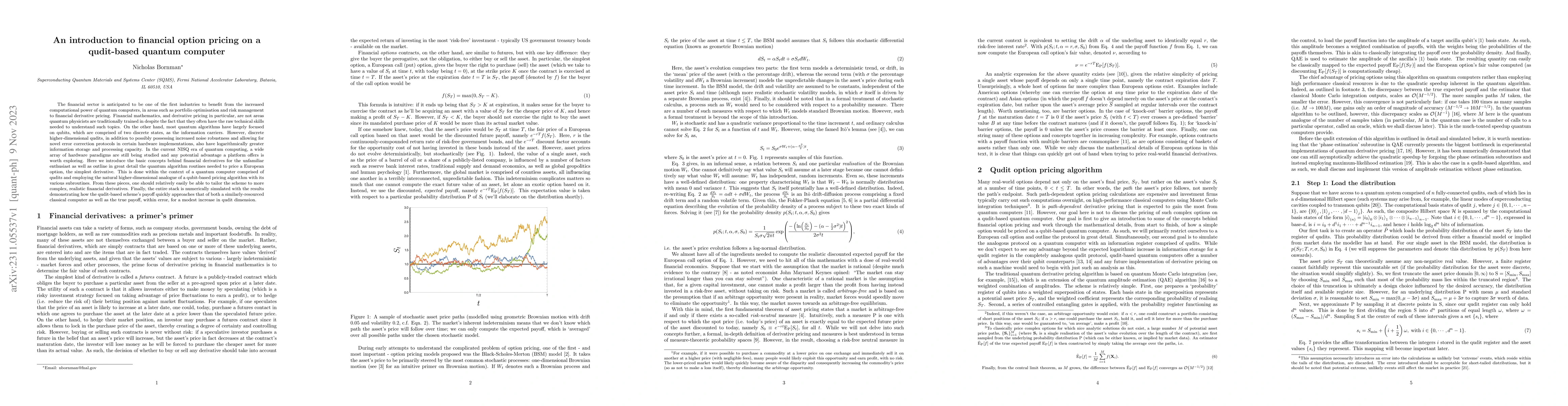

The financial sector is anticipated to be one of the first industries to benefit from the increased computational power of quantum computers, in areas such as portfolio optimisation and risk management to financial derivative pricing. Financial mathematics, and derivative pricing in particular, are not areas quantum physicists are traditionally trained in despite the fact that they often have the raw technical skills needed to understand such topics. On the other hand, most quantum algorithms have largely focused on qubits, which are comprised of two discrete states, as the information carriers. However, discrete higher-dimensional qudits, in addition to possibly possessing increased noise robustness and allowing for novel error correction protocols in certain hardware implementations, also have logarithmically greater information storage and processing capacity. In the current NISQ era of quantum computing, a wide array of hardware paradigms are still being studied and any potential advantage a platform offers is worth exploring. Here we introduce the basic concepts behind financial derivatives for the unfamiliar enthusiast as well as outline in great detail the quantum algorithm routines needed to price a European option, the simplest derivative. This is done within the context of a quantum computer comprised of qudits and employing the natural higher-dimensional analogue of a qubit-based pricing algorithm with its various subroutines. From these pieces, one should relatively easily be able to tailor the scheme to more complex, realistic financial derivatives. Finally, the entire stack is numerically simulated with the results demonstrating how the qudit-based scheme's payoff quickly approaches that of both a similarly-resourced classical computer as well as the true payoff, within error, for a modest increase in qudit dimension.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOption pricing under stochastic volatility on a quantum computer

Guoming Wang, Angus Kan

| Title | Authors | Year | Actions |

|---|

Comments (0)