Summary

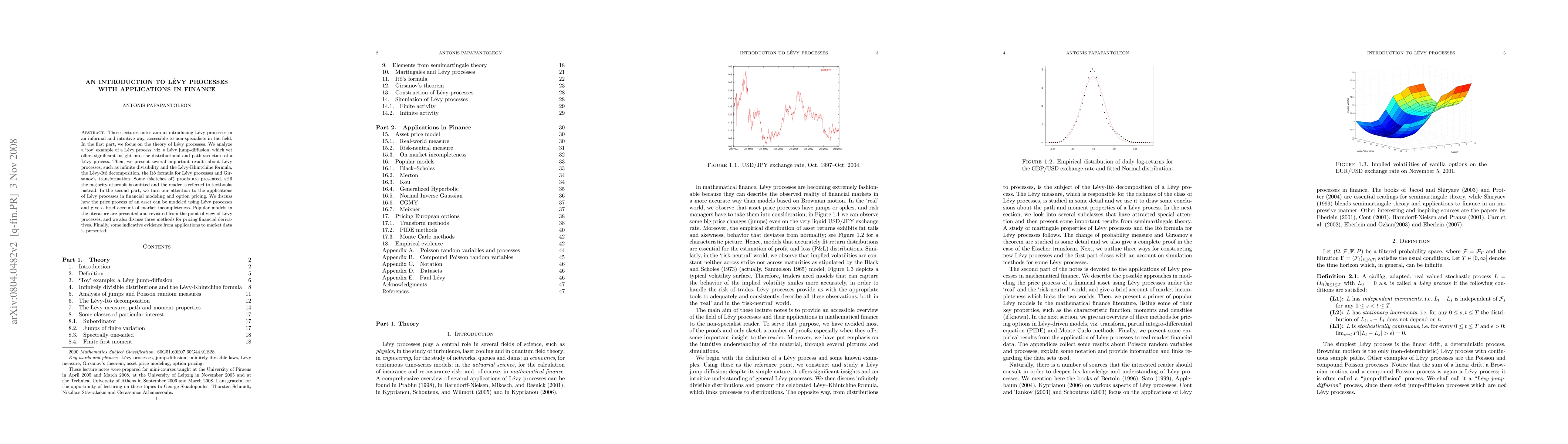

These lectures notes aim at introducing L\'{e}vy processes in an informal and intuitive way, accessible to non-specialists in the field. In the first part, we focus on the theory of L\'{e}vy processes. We analyze a `toy' example of a L\'{e}vy process, viz. a L\'{e}vy jump-diffusion, which yet offers significant insight into the distributional and path structure of a L\'{e}vy process. Then, we present several important results about L\'{e}vy processes, such as infinite divisibility and the L\'{e}vy-Khintchine formula, the L\'{e}vy-It\^{o} decomposition, the It\^{o} formula for L\'{e}vy processes and Girsanov's transformation. Some (sketches of) proofs are presented, still the majority of proofs is omitted and the reader is referred to textbooks instead. In the second part, we turn our attention to the applications of L\'{e}vy processes in financial modeling and option pricing. We discuss how the price process of an asset can be modeled using L\'{e}vy processes and give a brief account of market incompleteness. Popular models in the literature are presented and revisited from the point of view of L\'{e}vy processes, and we also discuss three methods for pricing financial derivatives. Finally, some indicative evidence from applications to market data is presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)