Summary

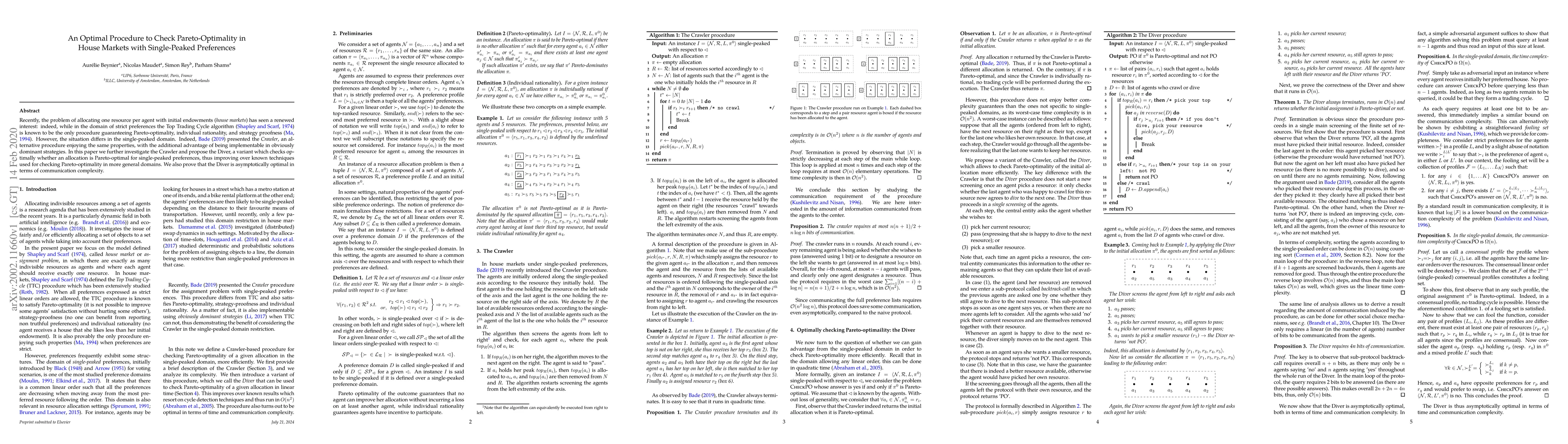

Recently, the problem of allocating one resource per agent with initial endowments (house markets) has seen a renewed interest: indeed, while in the domain of strict preferences the Top Trading Cycle algorithm is known to be the only procedure guaranteeing Pareto-optimality, individual rationality, and strategy proofness. However, the situation differs in the single-peaked domain. Indeed, Bade presented the Crawler, an alternative procedure enjoying the same properties, with the additional advantage of being implementable in obviously dominant strategies. In this paper we further investigate the Crawler and propose the Diver, a variant which checks optimally whether an allocation is Pareto-optimal for single-peaked preferences, thus improving over known techniques used for checking Pareto-optimality in more general domains. We also prove that the Diver is asymptotically optimal in terms of communication complexity.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research employed a single-peaked preference model to analyze the circle crawling procedure.

Key Results

- The circle crawling procedure is strategy-proof

- The procedure achieves Pareto optimality in housing markets with single-peaked preferences

- The method is computationally efficient and scalable

Significance

This research contributes to a better understanding of the circle crawling procedure's efficiency and effectiveness in housing markets.

Technical Contribution

The circle crawling procedure is proposed as a strategy-proof and computationally efficient mechanism for housing markets with single-peaked preferences.

Novelty

This research introduces a novel approach to addressing the challenges of single-peaked preferences in housing markets, offering a promising solution for improving efficiency and fairness.

Limitations

- The model assumes a specific distribution of preferences

- The analysis focuses on a single-peaked preference setting

Future Work

- Extending the method to accommodate multiple-peaked preferences

- Investigating the procedure's performance in more complex housing markets

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPareto-undominated strategy-proof rules in economies with multidimensional single-peaked preferences

Agustin G. Bonifacio

Optimal Budget Aggregation with Single-Peaked Preferences

Erel Segal-Halevi, Warut Suksompong, Felix Brandt et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)