Summary

Estimating large covariance and precision matrices are fundamental in modern multivariate analysis. The problems arise from statistical analysis of large panel economics and finance data. The covariance matrix reveals marginal correlations between variables, while the precision matrix encodes conditional correlations between pairs of variables given the remaining variables. In this paper, we provide a selective review of several recent developments on estimating large covariance and precision matrices. We focus on two general approaches: rank based method and factor model based method. Theories and applications of both approaches are presented. These methods are expected to be widely applicable to analysis of economic and financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

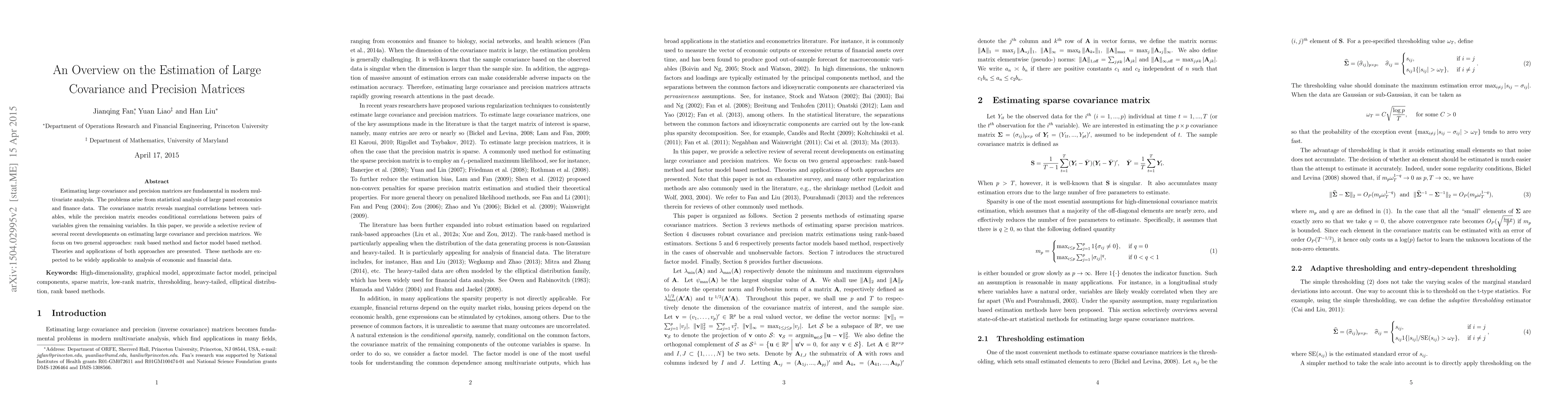

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)