Summary

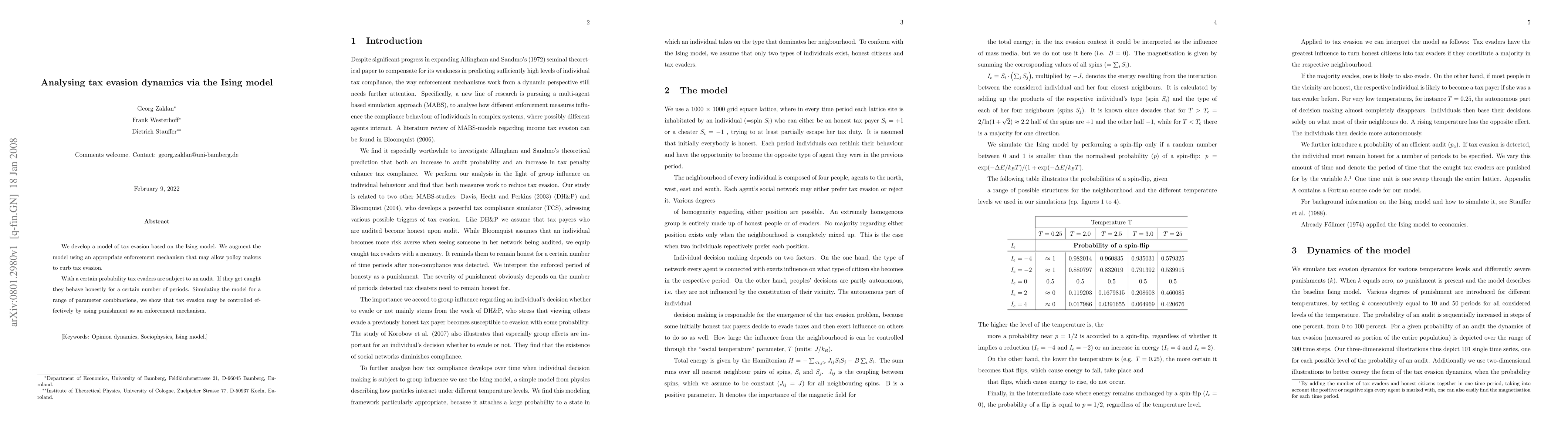

We develop a model of tax evasion based on the Ising model. We augment the model using an appropriate enforcement mechanism that may allow policy makers to curb tax evasion. With a certain probability tax evaders are subject to an audit. If they get caught they behave honestly for a certain number of periods. Simulating the model for a range of parameter combinations, we show that tax evasion may be controlled effectively by using punishment as an enforcement mechanism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)