Summary

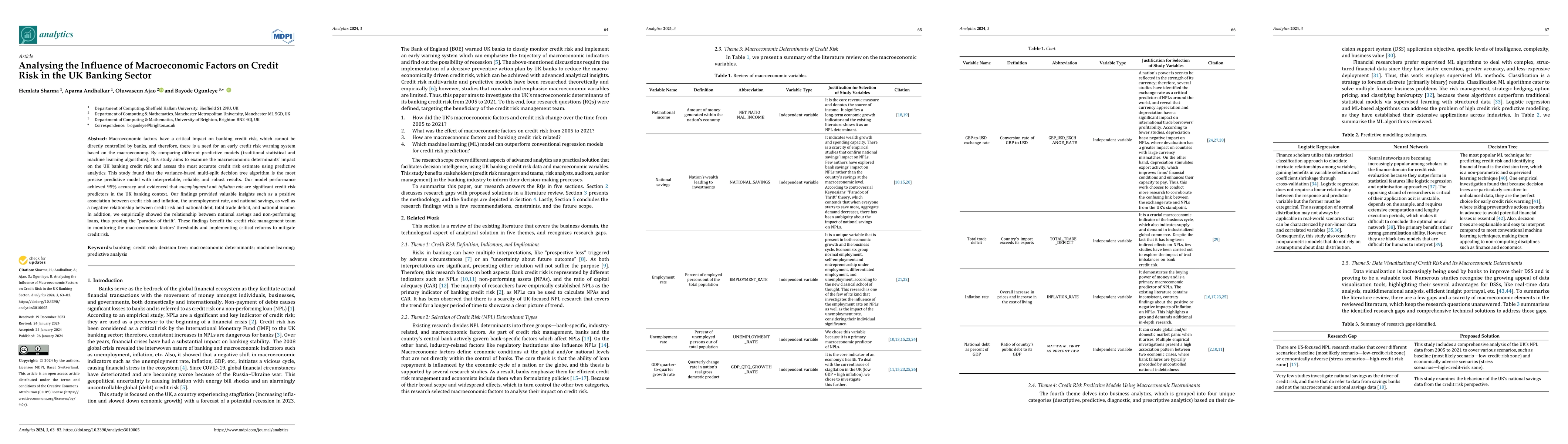

Macroeconomic factors have a critical impact on banking credit risk, which cannot be directly controlled by banks, and therefore, there is a need for an early credit risk warning system based on the macroeconomy. By comparing different predictive models (traditional statistical and machine learning algorithms), this study aims to examine the macroeconomic determinants impact on the UK banking credit risk and assess the most accurate credit risk estimate using predictive analytics. This study found that the variance-based multi-split decision tree algorithm is the most precise predictive model with interpretable, reliable, and robust results. Our model performance achieved 95% accuracy and evidenced that unemployment and inflation rate are significant credit risk predictors in the UK banking context. Our findings provided valuable insights such as a positive association between credit risk and inflation, the unemployment rate, and national savings, as well as a negative relationship between credit risk and national debt, total trade deficit, and national income. In addition, we empirically showed the relationship between national savings and non-performing loans, thus proving the paradox of thrift. These findings benefit the credit risk management team in monitoring the macroeconomic factors thresholds and implementing critical reforms to mitigate credit risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPropagation of a carbon price in a credit portfolio through macroeconomic factors

Jean-François Chassagneux, Antoine Jacquier, Géraldine Bouveret et al.

Non-stationary Financial Risk Factors and Macroeconomic Vulnerability for the UK

Tibor Szendrei, Katalin Varga

| Title | Authors | Year | Actions |

|---|

Comments (0)