Authors

Summary

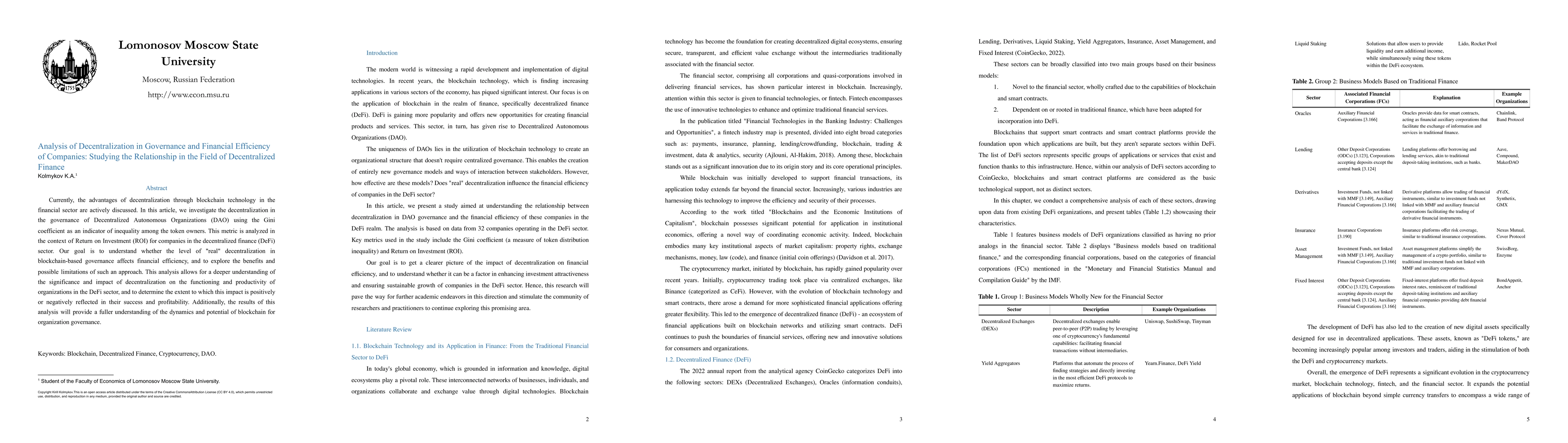

Currently, the advantages of decentralization through blockchain technology in the financial sector are actively discussed. In this article, we investigate the decentralization in the governance of Decentralized Autonomous Organizations (DAO) using the Gini coefficient as an indicator of inequality among the token owners. This metric is analyzed in the context of Return on Investment (ROI) for companies in the decentralized finance (DeFi) sector. Our goal is to understand whether the level of "real" decentralization in blockchain-based governance affects financial efficiency, and to explore the benefits and possible limitations of such an approach. This analysis allows for a deeper understanding of the significance and impact of decentralization on the functioning and productivity of organizations in the DeFi sector, and to determine the extent to which this impact is positively or negatively reflected in their success and profitability. Additionally, the results of this analysis will provide a fuller understanding of the dynamics and potential of blockchain for organization governance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecentralization illusion in Decentralized Finance: Evidence from tokenized voting in MakerDAO polls

Xiaotong Sun, Charalampos Stasinakis, Georigios Sermpinis

A Comprehensive Study of Governance Issues in Decentralized Finance Applications

Xiaofei Xie, Ye Liu, Yi Li et al.

Decentralized Finance: Protocols, Risks, and Governance

Garud Iyengar, Agostino Capponi, Jay Sethuraman

No citations found for this paper.

Comments (0)