Authors

Summary

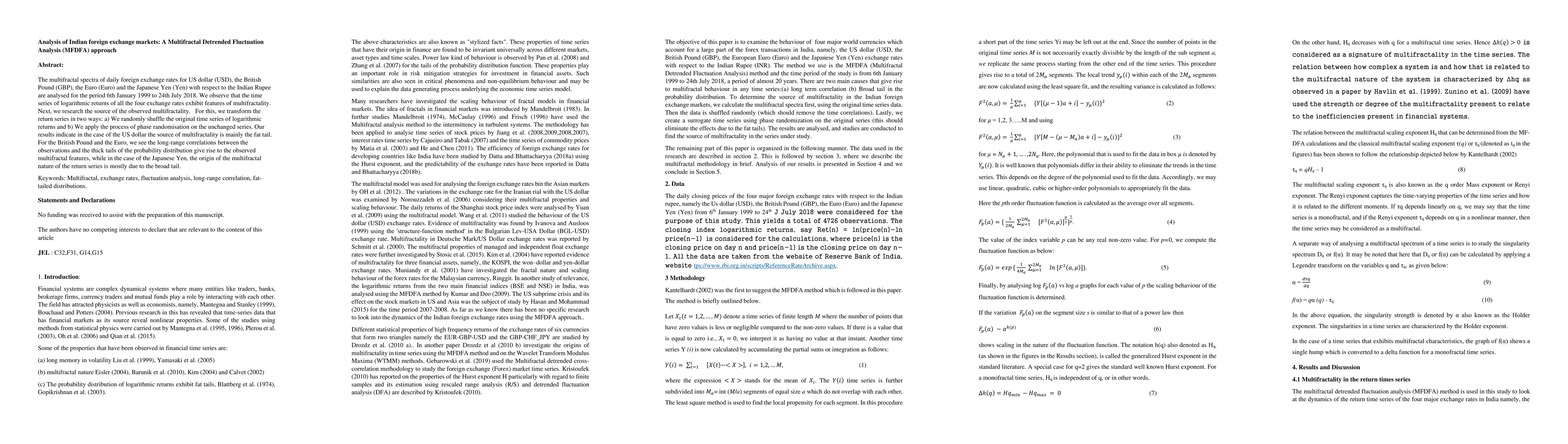

The multifractal spectra of daily foreign exchange rates for US dollar (USD), the British Pound (GBP), the Euro (Euro) and the Japanese Yen (Yen) with respect to the Indian Rupee are analysed for the period 6th January 1999 to 24th July 2018. We observe that the time series of logarithmic returns of all the four exchange rates exhibit features of multifractality. Next, we research the source of the observed multifractality. For this, we transform the return series in two ways: a) We randomly shuffle the original time series of logarithmic returns and b) We apply the process of phase randomisation on the unchanged series. Our results indicate in the case of the US dollar the source of multifractality is mainly the fat tail. For the British Pound and the Euro, we see the long-range correlations between the observations and the thick tails of the probability distribution give rise to the observed multifractal features, while in the case of the Japanese Yen, the origin of the multifractal nature of the return series is mostly due to the broad tail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMFDFA: Efficient Multifractal Detrended Fluctuation Analysis in Python

Jürgen Kurths, Dirk Witthaut, Leonardo Rydin Gorjão et al.

No citations found for this paper.

Comments (0)