Authors

Summary

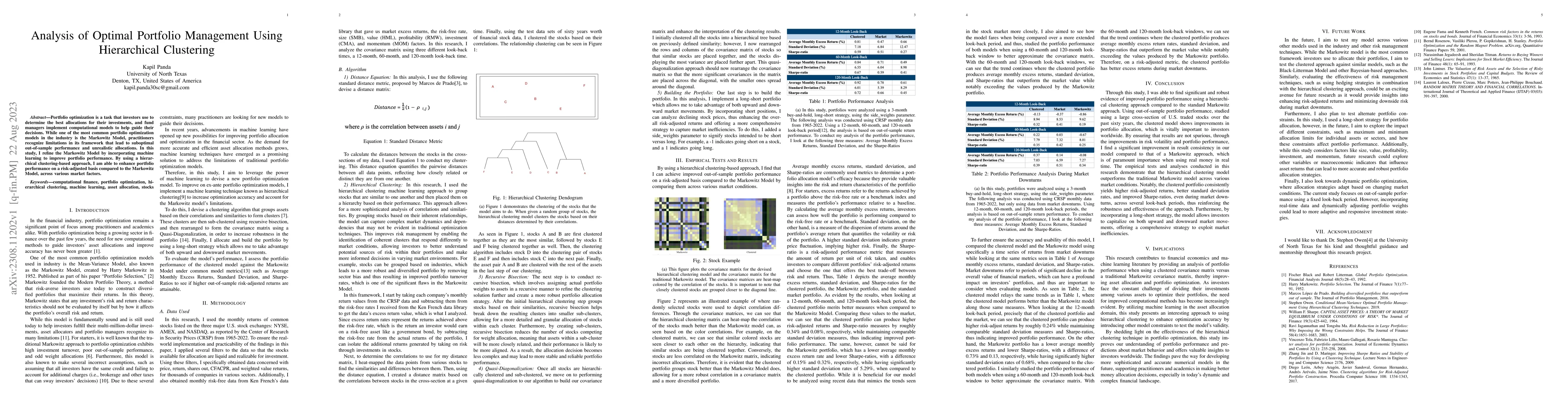

Portfolio optimization is a task that investors use to determine the best allocations for their investments, and fund managers implement computational models to help guide their decisions. While one of the most common portfolio optimization models in the industry is the Markowitz Model, practitioners recognize limitations in its framework that lead to suboptimal out-of-sample performance and unrealistic allocations. In this study, I refine the Markowitz Model by incorporating machine learning to improve portfolio performance. By using a hierarchical clustering-based approach, I am able to enhance portfolio performance on a risk-adjusted basis compared to the Markowitz Model, across various market factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCAD: Clustering And Deep Reinforcement Learning Based Multi-Period Portfolio Management Strategy

Jionglong Su, Zhengyong Jiang, Jeyan Thiayagalingam et al.

No citations found for this paper.

Comments (0)