Summary

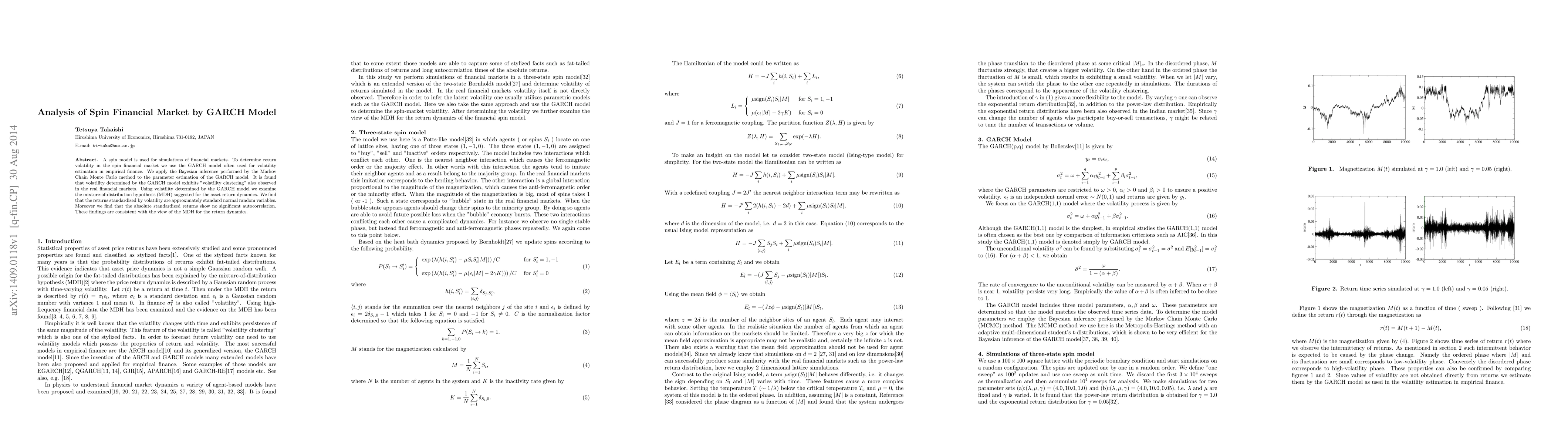

A spin model is used for simulations of financial markets. To determine return volatility in the spin financial market we use the GARCH model often used for volatility estimation in empirical finance. We apply the Bayesian inference performed by the Markov Chain Monte Carlo method to the parameter estimation of the GARCH model. It is found that volatility determined by the GARCH model exhibits "volatility clustering" also observed in the real financial markets. Using volatility determined by the GARCH model we examine the mixture-of-distribution hypothesis (MDH) suggested for the asset return dynamics. We find that the returns standardized by volatility are approximately standard normal random variables. Moreover we find that the absolute standardized returns show no significant autocorrelation. These findings are consistent with the view of the MDH for the return dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Multi-agent Market Model Can Explain the Impact of AI Traders in Financial Markets -- A New Microfoundations of GARCH model

Masanori Hirano, Kei Nakagawa, Kentaro Minami et al.

Integrated GARCH-GRU in Financial Volatility Forecasting

Zhenyu Cui, Steve Yang, Jingyi Wei

| Title | Authors | Year | Actions |

|---|

Comments (0)