Summary

We study the archetypal functional equation of the form $y(x)=\iint_{\mathbb{R}^2} y(a(x-b))\,\mu(\mathrm{d}a,\mathrm{d}b)$ ($x\in\mathbb{R}$), where $\mu$ is a probability measure on $\mathbb{R}^2$; equivalently, $y(x)=\mathbb{E}\{y(\alpha(x-\beta))\}$, where $\mathbb{E}$ is expectation with respect to the distribution $\mu$ of random coefficients $(\alpha,\beta)$. Existence of non-trivial (i.e., non-constant) bounded continuous solutions is governed by the value $K:=\iint_{\mathbb{R}^2}\ln|a|\,\mu(\mathrm{d}a,\mathrm{d}b)=\mathbb{E}\{\ln|\alpha|\}$; namely, under mild technical conditions no such solutions exist whenever $K<0$, whereas if $K>0$ (and $\alpha>0$) then there is a non-trivial solution constructed as the distribution function of a certain random series representing a self-similar measure associated with $(\alpha,\beta)$. Further results are obtained in the supercritical case $K>0$, including existence, uniqueness and a maximum principle. The case with $\mathbb{P}(\alpha<0)>0$ is drastically different from that with $\alpha>0$; in particular, we prove that a bounded solution $y(\cdot)$ possessing limits at $\pm\infty$ must be constant. The proofs employ martingale techniques applied to the martingale $y(X_n)$, where $(X_n)$ is an associated Markov chain with jumps of the form $x\rightsquigarrow\alpha(x-\beta)$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

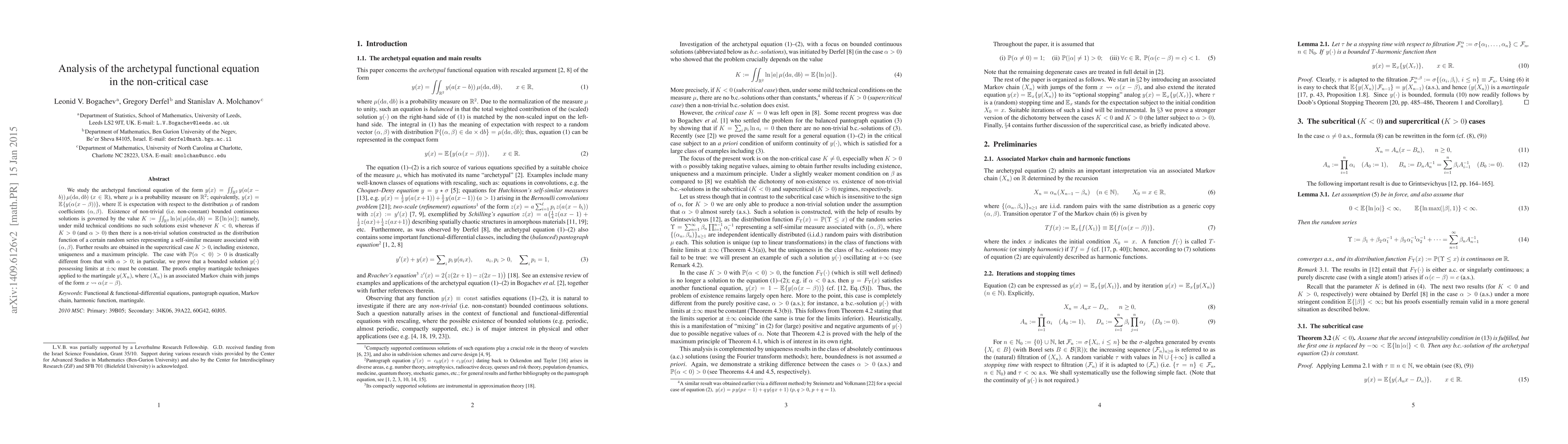

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)