Summary

Since 2008, the network analysis of financial systems is one of the most important subjects in economics. In this paper, we have used the complexity approach and Random Matrix Theory (RMT) for analyzing the global banking network. By applying this method on a cross border lending network, it is shown that the network has been denser and the connectivity between peripheral nodes and the central section has risen. Also, by considering the collective behavior of the system and comparing it with the shuffled one, we can see that this network obtains a specific structure. By using the inverse participation ratio concept, we can see that after 2000, the participation of different modes to the network has increased and tends to the market mode of the system. Although no important change in the total market share of trading occurs, through the passage of time, the contribution of some countries in the network structure has increased. The technique proposed in the paper can be useful for analyzing different types of interaction networks between countries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

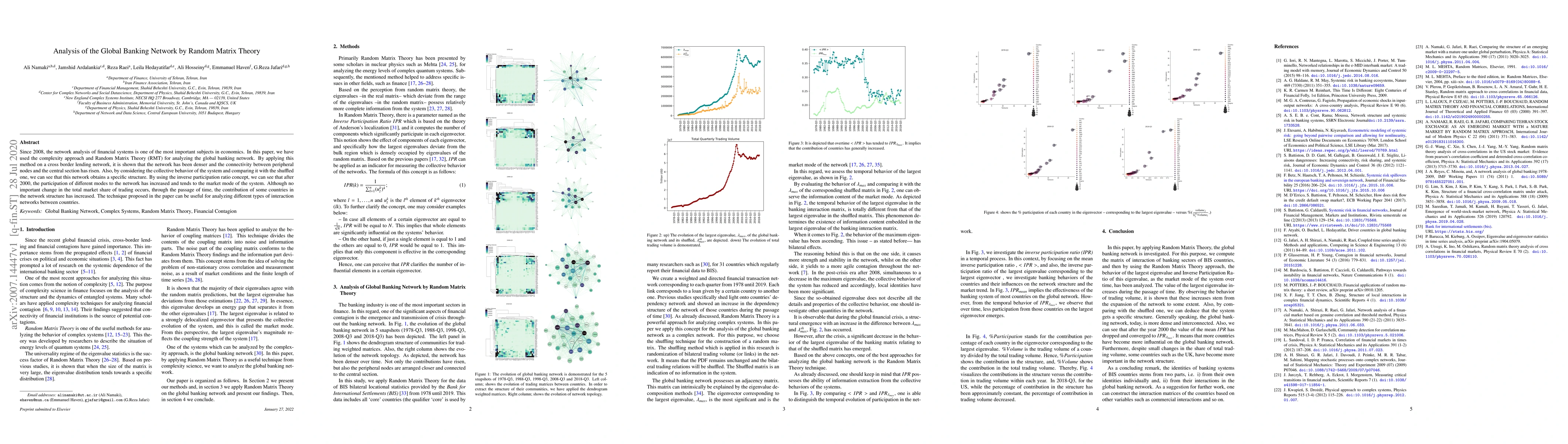

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNetwork Analysis of Global Banking Systems and Detection of Suspicious Transactions

Anthony Bonato, Adam Szava, Juan Chavez Palan

| Title | Authors | Year | Actions |

|---|

Comments (0)