Authors

Summary

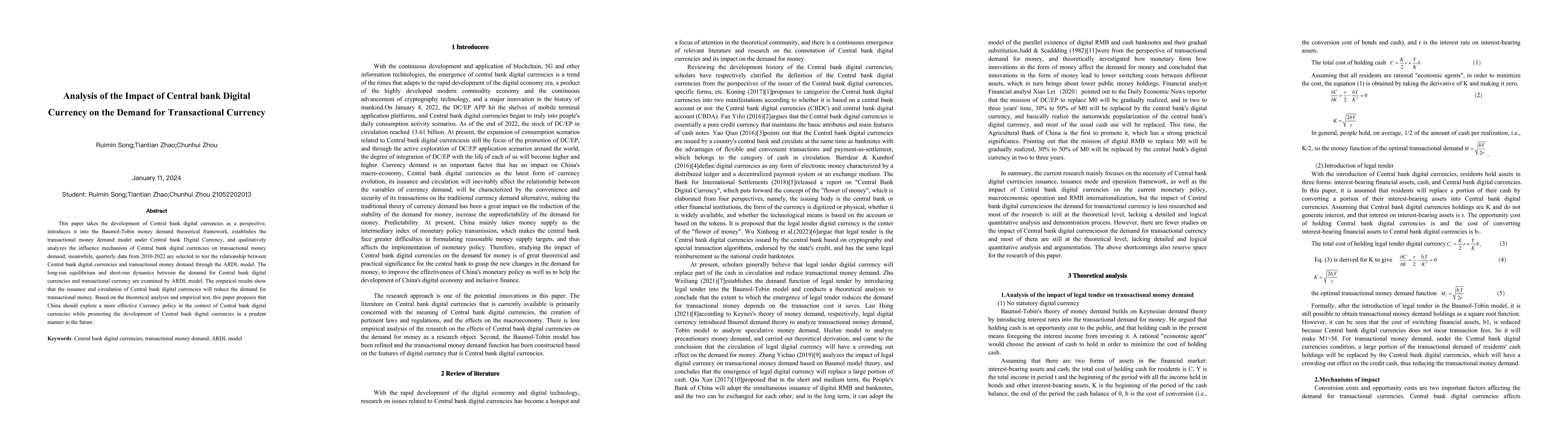

This paper takes the development of Central bank digital currencies as a perspective, introduces it into the Baumol-Tobin money demand theoretical framework, establishes the transactional money demand model under Central bank Digital Currency, and qualitatively analyzes the influence mechanism of Central bank digital currencies on transactional money demand; meanwhile, quarterly data from 2010-2022 are selected to test the relationship between Central bank digital currencies and transactional money demand through the ARDL model. The long-run equilibrium and short-run dynamics between the demand for Central bank digital currencies and transactional currency are examined by ARDL model. The empirical results show that the issuance and circulation of Central bank digital currencies will reduce the demand for transactional money. Based on the theoretical analysis and empirical test, this paper proposes that China should explore a more effective Currency policy in the context of Central bank digital currencies while promoting the development of Central bank digital currencies in a prudent manner in the future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCentral Bank Digital Currency: Demand Shocks and Optimal Monetary Policy

Hanfeng Chen, Maria Elena Filippin

Central Bank Digital Currency with Collateral-constrained Banks

Hanfeng Chen, Maria Elena Filippin

| Title | Authors | Year | Actions |

|---|

Comments (0)