Authors

Summary

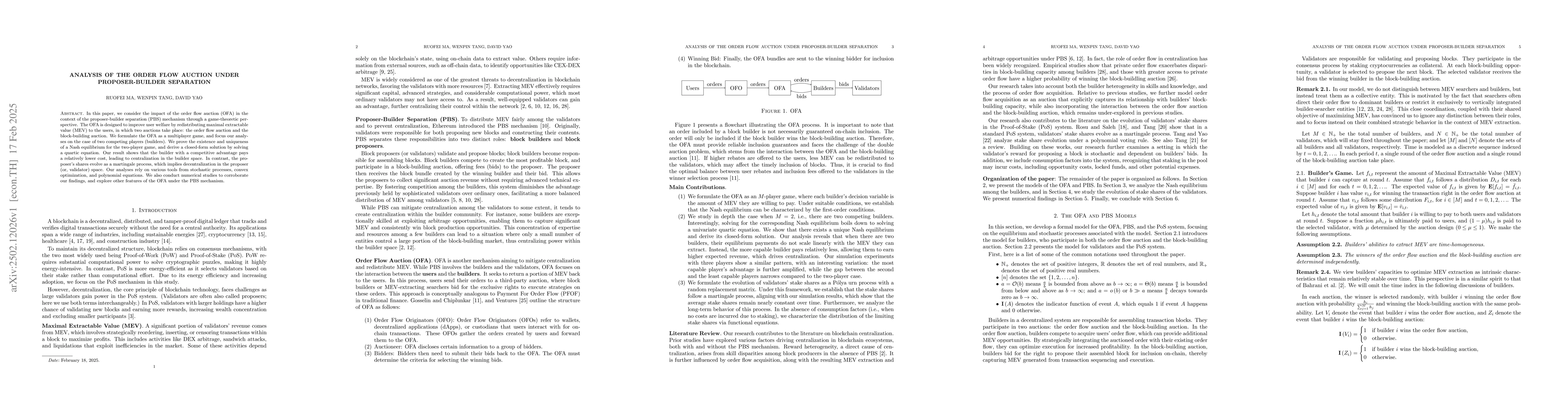

In this paper, we consider the impact of the order flow auction (OFA) in the context of the proposer-builder separation (PBS) mechanism through a game-theoretic perspective. The OFA is designed to improve user welfare by redistributing maximal extractable value (MEV) to the users, in which two auctions take place: the order flow auction and the block-building auction. We formulate the OFA as a multiplayer game, and focus our analyses on the case of two competing players (builders). We prove the existence and uniqueness of a Nash equilibrium for the two-player game, and derive a closed-form solution by solving a quartic equation. Our result shows that the builder with a competitive advantage pays a relatively lower cost, leading to centralization in the builder space. In contrast, the proposer's shares evolve as a martingale process, which implies decentralization in the proposer (or, validator) space. Our analyses rely on various tools from stochastic processes, convex optimization, and polynomial equations. We also conduct numerical studies to corroborate our findings, and explore other features of the OFA under the PBS mechanism.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper formulates the Order Flow Auction (OFA) within a Proposer-Builder Separation (PBS) mechanism as a multiplayer game, focusing on a two-player case to prove the existence and uniqueness of a Nash equilibrium and deriving a closed-form solution via a quartic equation. Numerical studies corroborate the findings.

Key Results

- Existence and uniqueness of Nash equilibrium for two-player game is proven.

- Closed-form solution for equilibrium is derived through a quartic equation.

- Builder with competitive advantage pays a relatively lower cost, leading to centralization in builder space.

- Proposer's shares evolve as a martingale process, indicating decentralization in proposer space.

- Numerical studies support the analytical findings.

Significance

This research provides a game-theoretic analysis of OFA under PBS, offering insights into the dynamics of MEV redistribution and potential centralization risks in blockchain systems.

Technical Contribution

The paper establishes a unique Nash equilibrium for the OFA under PBS, providing a closed-form solution and analyzing the evolution of shares through stochastic processes.

Novelty

The work introduces a novel approach to analyze the OFA within the PBS framework, offering detailed insights into the equilibrium behavior and potential centralization risks in blockchain systems.

Limitations

- The analysis primarily focuses on two-player interaction, with numerical simulations for multi-player settings.

- Assumptions made for the model may not fully capture the complexities of real-world blockchain systems.

Future Work

- Extending the analysis to more than two players to understand broader market dynamics.

- Investigating the impact of varying network parameters on equilibrium outcomes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Centralizing Effects of Private Order Flow on Proposer-Builder Separation

Max Resnick, Tivas Gupta, Mallesh M Pai

Centralization in Block Building and Proposer-Builder Separation

Tim Roughgarden, Maryam Bahrani, Pranav Garimidi

Role-Selection Game in Block Production under Proposer-Builder Separation

Zining Wang, Yanzhen Li

Ethereum's Proposer-Builder Separation: Promises and Realities

Roger Wattenhofer, Lioba Heimbach, Christof Ferreira Torres et al.

No citations found for this paper.

Comments (0)