Summary

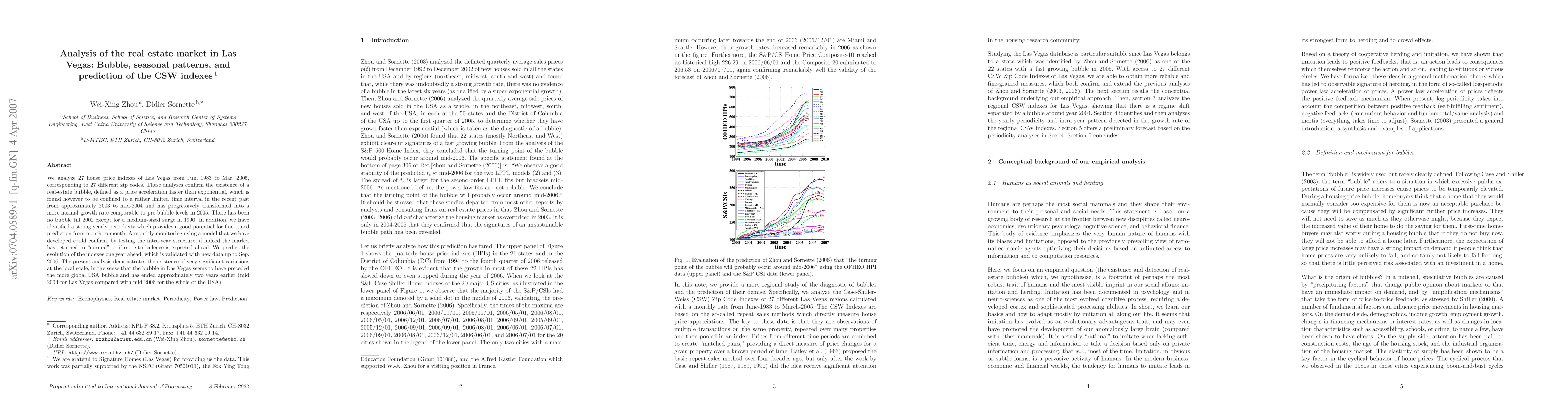

We analyze 27 house price indexes of Las Vegas from Jun. 1983 to Mar. 2005, corresponding to 27 different zip codes. These analyses confirm the existence of a real-estate bubble, defined as a price acceleration faster than exponential, which is found however to be confined to a rather limited time interval in the recent past from approximately 2003 to mid-2004 and has progressively transformed into a more normal growth rate comparable to pre-bubble levels in 2005. There has been no bubble till 2002 except for a medium-sized surge in 1990. In addition, we have identified a strong yearly periodicity which provides a good potential for fine-tuned prediction from month to month. A monthly monitoring using a model that we have developed could confirm, by testing the intra-year structure, if indeed the market has returned to ``normal'' or if more turbulence is expected ahead. We predict the evolution of the indexes one year ahead, which is validated with new data up to Sep. 2006. The present analysis demonstrates the existence of very significant variations at the local scale, in the sense that the bubble in Las Vegas seems to have preceded the more global USA bubble and has ended approximately two years earlier (mid 2004 for Las Vegas compared with mid-2006 for the whole of the USA).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)