Summary

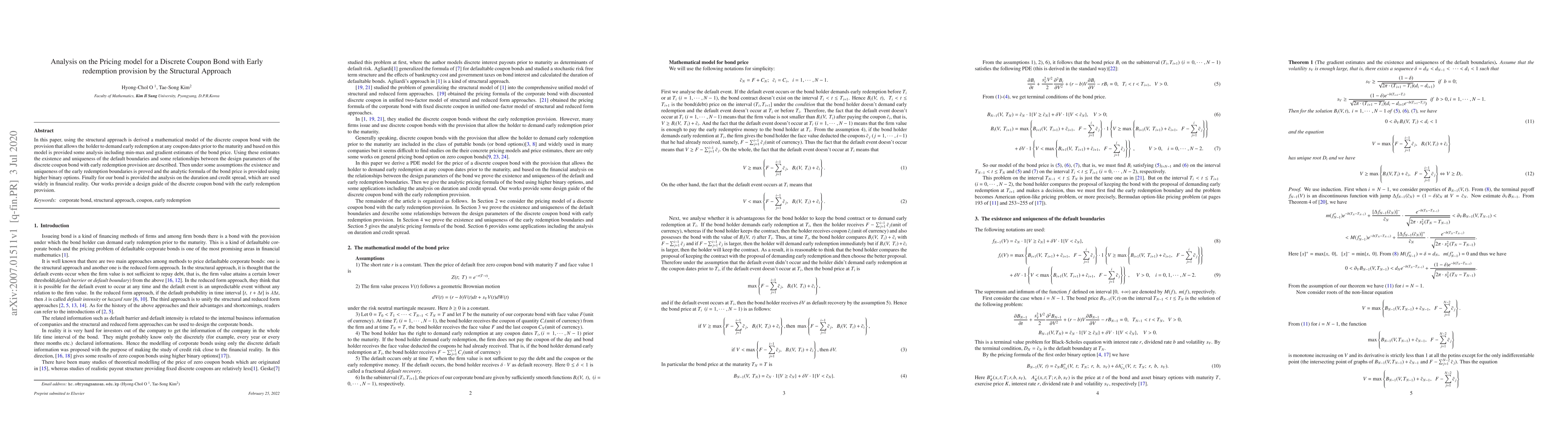

In this paper, using the structural approach is derived a mathematical model of the discrete coupon bond with the provision that allow the holder to demand early redemption at any coupon dates prior to the maturity and based on this model is provided some analysis including min-max and gradient estimates of the bond price. Using these estimates the existence and uniqueness of the default boundaries and some relationships between the design parameters of the discrete coupon bond with early redemption provision are described. Then under some assumptions the existence and uniqueness of the early redemption boundaries is proved and the analytic formula of the bond price is provided using higher binary options. Finally for our bond is provided the analysis on the duration and credit spread, which are used widely in financial reality. Our works provide a design guide of the discrete coupon bond with the early redemption provision

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)