Summary

We derive analytic formulae which link $\alpha$, $\nu$ and $\rho$ parameters in Andreasen-Huge style SABR model to the ATM price and option prices at four strikes close to ATM. Based on these formulae we give a characterisation for the SABR parameters in terms of derivatives of the swap rate forward probability density function. We test the analytic result in the application to the interest rate futures option market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

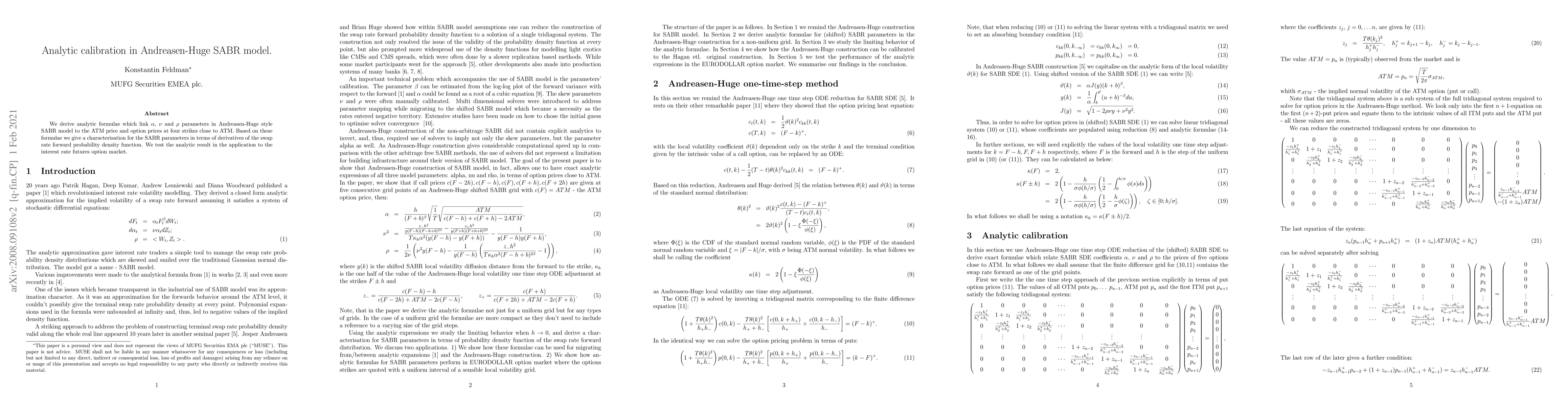

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)